Here’s a question to think about: Can someone with millions in assets still feel trapped financially? The answer might surprise you. It all comes down to understanding the key difference between net worth and true wealth.

Having a big number on your financial statement doesn’t always mean you’re living the life you want. If your money isn’t working for you—if it’s sitting in places you can’t easily access—it’s not giving you the freedom you deserve. At Pennbook Center (PBC), we’re all about helping you see beyond the numbers and focus on what really matters: creating a financial foundation that supports the life you dream of living. In this article, we’ll break down what wealth truly means, how it differs from net worth, and how you can align your finances with your personal freedom.

Table of Contents

Read also:Isaac Rochells Net Worth In 2025 A Closer Look At His Nfl Career Salary And Financial Insights

- What’s the Real Difference Between Net Worth and Wealth?

- Why Does Wealth Equal Financial Freedom?

- How Can You Measure Wealth in Real-Life Terms?

- How Passive Income Changes the Game

- Why Liquidity Matters in True Wealth

- Case Studies: More Money Doesn’t Always Mean More Wealth

- Transitioning from High Net Worth to Real Wealth

- Can You Build Wealth Without a High Net Worth?

- Final Thoughts

What’s the Real Difference Between Net Worth and Wealth?

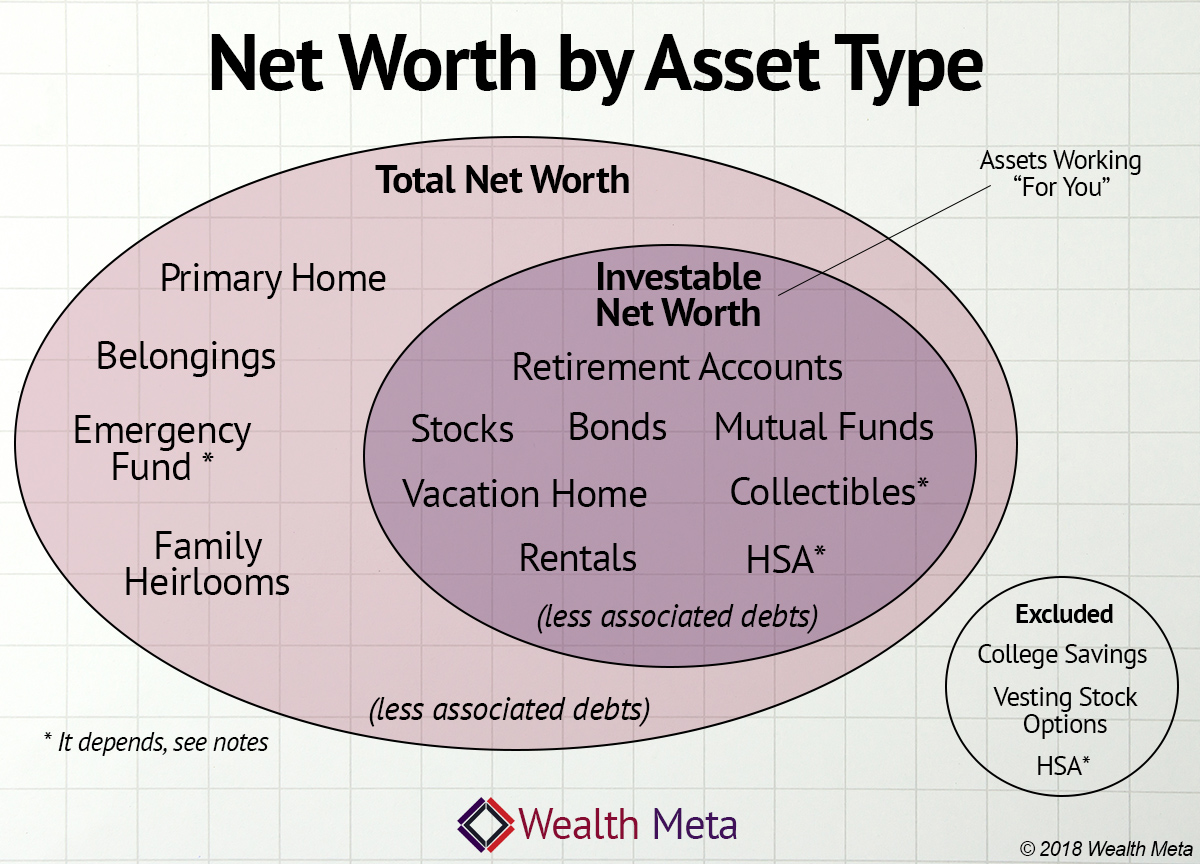

Let’s clear something up right away: just because someone has a high net worth doesn’t mean they’re financially secure. Net worth is essentially a snapshot of your financial situation—your assets minus liabilities. It’s like taking a picture of your finances at a single moment in time. But here’s the thing: that picture doesn’t tell the whole story. Wealth, on the other hand, goes much deeper. It’s about the freedom your money gives you, not just the size of the number.

Think about it this way: someone might have a big house, fancy cars, and a well-funded retirement account. On paper, they look wealthy. But if most of that money is tied up in places they can’t easily access—like selling their house or withdrawing from retirement accounts without penalties—they might not be as financially free as they seem. That’s where the difference between net worth and wealth becomes so important.

Why Does Wealth Equal Financial Freedom?

When we talk about wealth, we’re really talking about financial freedom. It’s not about how much money you have—it’s about how long you could sustain your lifestyle without needing to work. One of the biggest principles here is that wealth is less about dollars and more about time.

Let’s compare two people. The first has millions invested in retirement accounts, but no assets generating passive income. The second has a smaller net worth but earns enough passive income to cover all their expenses. Who’s truly wealthier? The second person, because they don’t need to trade their time for money—they’re financially free.

While the first person might seem richer on paper, they’re not necessarily wealthier in practice. That’s the power of usable, accessible money.

Read also:Cristela Alonzos Journey Net Worth Career And Beyond

How Can You Measure Wealth in Real-Life Terms?

Net worth is a useful tool—it helps track progress—but it has its limits. Many people calculate their net worth based on assets that aren’t liquid, like their home, retirement savings, or collectibles. These things are valuable, but they’re not always easy to turn into cash when you need it.

For example, selling a house isn’t quick or simple. Withdrawing from a retirement account might come with taxes and penalties. In short, net worth often includes assets that aren’t readily usable in daily life.

Now, compare that to someone who generates consistent passive income from investments. If they earn, say, $10,000 a month in passive income, they can live comfortably without ever touching their net worth. That’s the practical definition of wealth: having money that works for you, not the other way around.

How Passive Income Changes the Game

One of the biggest differences between financial stress and financial freedom is passive income. This type of income comes from sources that don’t require constant effort, like rental properties, dividend-paying stocks, or online businesses.

These cash-flowing assets contribute to wealth by creating steady, predictable income streams. The more you rely on these sources, the less you depend on a traditional paycheck. Over time, this shift in income structure not only produces consistent income but also increases your financial flexibility.

When someone’s lifestyle is funded by these income-generating assets, they’re no longer tied to a 9-to-5 job. That’s when net worth becomes truly functional and starts working for them.

Why Liquidity Matters in True Wealth

It’s easy to be impressed by someone’s million-dollar home or seven-figure retirement account, but here’s the catch: those assets aren’t easily spendable. Liquidity—having cash or quickly accessible funds—matters a lot. You need money you can use to pay for day-to-day expenses.

Many high-net-worth individuals are actually asset-rich but cash-poor. Their money is tied up in things they can’t sell or access easily. This is why liquid assets are so important—they increase the amount of usable income you have and make you truly wealthy.

The bottom line? Net worth tells one story, but income usability tells the full story. Focus not just on what you own, but on what you can use when you need it.

Case Studies: More Money Doesn’t Always Mean More Wealth