Do you ever find yourself wondering if you’re part of the financial elite? If so, you’re definitely not alone. Countless people are curious about their place in today’s wealth hierarchy, and more specifically, what it takes to break into the top 2 percent. It’s not just about having a few investments or owning a home—it’s about understanding your entire financial picture and how your assets compare to others. Let’s break it down in a way that’s clear, actionable, and relatable.

Join us as we explore how much wealth you need to reach this milestone, what defines financial standing among the wealthiest, and how smart investment decisions can help you climb the ranks. Whether you’re just curious or actively working toward this goal, this guide is for you.

Table of Contents

Read also:Tommy Chongs Net Worth In 2025 The Story Behind His Success

- How Much Wealth Do You Need to Join the Top 2 Percent?

- What Defines Financial Standing Among the Wealthiest?

- How Do Your Financial Decisions Reflect Your Wealth Rank?

- How Do You Compare to Others in the Top Percentiles?

- What Investment Strategies Do the Top 2 Percent Follow?

- How Are Younger Individuals Managing Their Wealth?

- Why Do Many Wealthy People Turn to Philanthropy?

- What Practical Steps Can You Take to Reach the Top 2 Percent?

- Final Thoughts

How Much Wealth Do You Need to Join the Top 2 Percent?

If you’re aiming to be part of the top 2 percent in net worth, here’s the number to keep in mind: around $2.7 million by 2025. That’s the threshold that separates the financially elite from the rest of the pack. So, where do you stand right now? If your net worth is hovering near $2.2 million, you’re probably feeling pretty good. That’s the figure many Americans say defines "feeling rich," according to the Schwab Modern Wealth Survey. But if you want to officially break into the top 2 percent, you’ll need to aim a bit higher. And remember, this number is only going to grow over time.

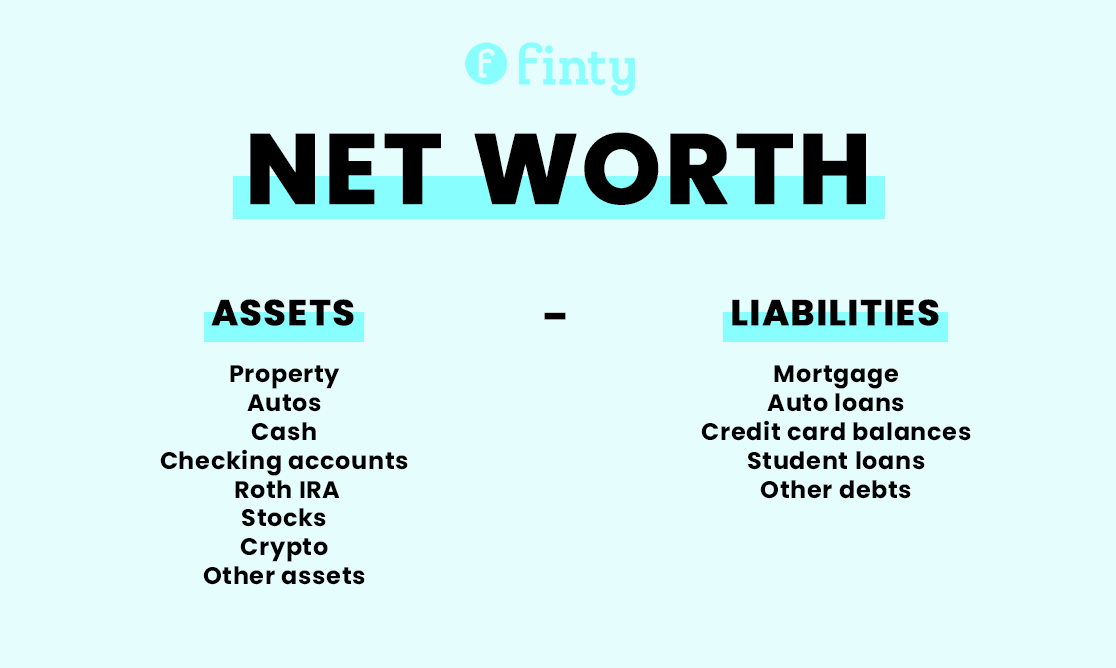

Your financial position isn’t just about how much money you earn—it’s about the balance between what you own (assets) and what you owe (liabilities). Once you understand this equation, you can start taking concrete steps to move closer to that coveted milestone. The key is not just earning but building wealth through smart decisions.

What Defines Financial Standing Among the Wealthiest?

Your financial standing is all about one simple but powerful equation: how much you truly own after subtracting what you owe. Here’s how you calculate it:

- Assets: This includes cash, savings, investments, retirement accounts, real estate, and any other valuable items you own.

- Liabilities: This covers everything from mortgages and car loans to student debt and credit card balances.

In short, your net worth = total assets – total liabilities. It’s not just about the money in your bank account—it’s about the big picture. If you’ve got property, savings, and investments, but also some debt, you’re already on the right track. Understanding your net worth helps you see exactly where you stand in the wealth hierarchy and how close you are to reaching the top brackets.

How Do Your Financial Decisions Reflect Your Wealth Rank?

Once you’re near or within the top 2 percent, your financial decisions start to look a little different. You’re not just saving—you’re actively growing your wealth through smart investments. Here’s what a typical top-tier portfolio might look like:

Read also:Trixie Mattels Journey To Success Net Worth Career And Legacy

| Investment Type | % of Portfolio |

|---|---|

| Real Estate (Primary/Secondary) | 32% |

| Equities (Stocks) | 18% |

| Commercial Property | 14% |

| Bonds | 12% |

| Private Equity/Venture Capital | 6% |

| Luxury Assets (e.g., Art) | 5%+ |

High-net-worth individuals know how to put their money to work. They invest heavily in real estate, spread their wealth across equities and bonds, and explore high-growth opportunities like private equity. Some even dip into luxury assets like art, which appreciated by 29% in value last year alone. It’s all about diversification and finding the right balance between risk and reward.

How Do You Compare to Others in the Top Percentiles?

You might be doing well, but how do you stack up against others in the top percentiles? Here’s a quick breakdown:

- Top 1%: $11.6 million

- Top 2%: $2.7 million

- Top 5%: $1.17 million

- Top 10%: $970,900

- Median Net Worth (All Families): $192,900

- Mean Net Worth: $1,063,700

These numbers give you a clear idea of how the wealth threshold varies across the population. If you’re above $1 million, you’re already in the top 10 percent. But as you climb higher, the complexity—and the opportunities—only increase.