Ever dreamed of joining the financial elite? Reaching the top 5 percent net worth isn’t just about having a high income—it’s about how you grow, manage, and protect your wealth over time. This guide breaks it down for you and shows you how to climb the ranks of American wealth.

Table of Contents

- Understanding the Top 5 Percent Wealth Threshold

- How Your Assets Stack Up Against the Wealthiest 5 Percent

- Income Levels That Get You in the Top 5 Percent Club

- The Role of Age in Building Wealth to Reach the Top 5 Percent

- Investment Strategies of the Wealthiest 5 Percent

- The Power of Saving: The Foundation of Wealth Building

- Why a High Income Alone Won't Guarantee Elite Wealth

- How Age Influences Wealth Goals and Retirement Planning

- Tools to Track Your Progress Toward the Top 5 Percent

- Debunking Myths About High Net Worth Individuals

- Final Thoughts

Understanding the Top 5 Percent Wealth Threshold

Read also:Janeane Garofalos Net Worth In 2025 A Look At Her Wealth Salary And Career Success

Let’s get real for a moment. Being in the top 5 percent isn’t just about having more money than your neighbors. It’s about achieving a level of financial success that most people only dream about. According to the Federal Reserve’s Survey of Consumer Finances, the threshold starts at around $415,700 for young adults and can soar to $6.6 million by your 60s. That’s no small feat.

It’s not just about earning a big paycheck, though. People in this elite group have done more than just rake in the cash—they’ve made smart decisions about how to grow and protect their wealth over time. Whether it’s through long-term investments, effective risk management, or simply making the right financial moves, these individuals have built their net worth steadily and strategically.

As you age, your financial situation naturally evolves. Your net worth tends to increase because you accumulate more assets, pay off debts, and see your earnings peak during your mid-life years. It’s a journey, and every step matters.

How Your Assets Stack Up Against the Wealthiest 5 Percent

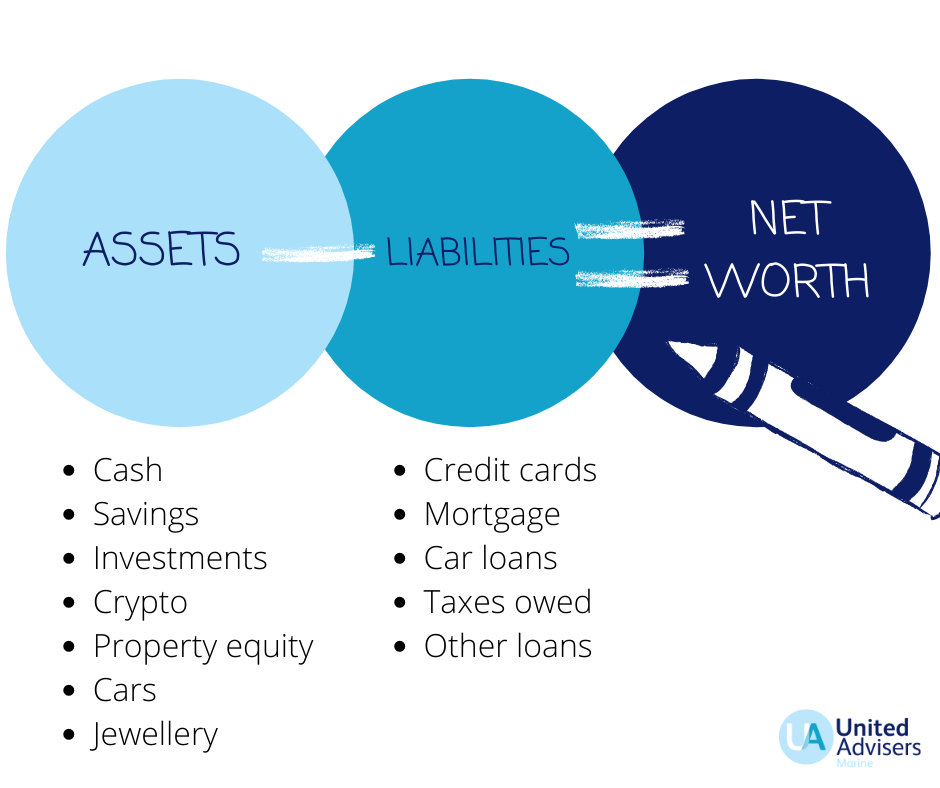

To break into the top 5 percent, it’s not enough to just have savings in the bank. You need a diversified portfolio of financial assets, including:

- Retirement accounts like 401(k)s and IRAs

- Stocks and ETFs, especially those in diversified funds like Vanguard’s VOO

- Real estate investments

- Business ownership or other income-generating assets

The composition of these assets plays a huge role in determining your overall wealth. If your retirement portfolio is robust, it shows that you’re not just living paycheck to paycheck—you’re building long-term wealth. Even if you don’t feel like a millionaire on a day-to-day basis, consistent investments in assets like the S&P 500 can quietly grow your wealth over time.

Your financial picture isn’t just about what you own—it’s also about how you manage your earnings. By your 50s, if you’re in the top percentile, your average net worth could reach around $5,001,600. That kind of figure doesn’t happen by accident—it’s the result of decades of smart investing and financial discipline.

Read also:Hiro Mashimas Net Worth In 2025 A Closer Look At The Manga Legends Wealth

Income Levels That Get You in the Top 5 Percent Club

While income plays a role in accumulating wealth, it’s not the only factor. To be in the top 5 percent by income, you’d need to earn around $598,825 annually in your 50s or $292,927 in your 30s. But here’s the kicker: even if you’re making a top-tier salary, only a small percentage of people in your age group actually achieve a top-tier net worth. Why? Because building wealth isn’t just about what you earn—it’s about how you convert that income into assets.

Your earning power fuels your savings, but it’s your discipline and strategy that truly transform that income into lasting wealth. It’s not about having a flashy paycheck—it’s about developing smart financial habits that set you up for long-term success.

The Role of Age in Building Wealth to Reach the Top 5 Percent

As you move through life, your financial journey changes. In your 20s, crossing the $415,700 mark might seem like a big deal. But by your 60s, that benchmark jumps to nearly $6.7 million. Here’s a quick look at how your net worth should grow over time:

| Age Group | 95th Percentile Net Worth |

|---|---|

| 18–29 | $415,700 |

| 30–39 | $1,104,100 |

| 40–49 | $2,551,500 |

| 50–59 | $5,001,600 |

| 60–69 | $6,684,220 |

| 70+ | $5,860,400 |

In your 40s and 50s, your income starts to play a bigger role in your financial standing, and the compounding effect of years of smart investing begins to show real results. The earlier you start, the more time your money has to grow.

Investment Strategies of the Wealthiest 5 Percent

If you’re serious about joining the top 5 percent, your investment strategy is key. These individuals often focus on:

- Low-cost index funds like the Vanguard S&P 500 ETF (VOO)

- Diversified portfolios that include bonds,