Hey there! Do you know what types of liabilities are shaping your financial life or the health of your business? Let's break it down together. Whether it's short-term obligations like paying wages and utility bills or long-term debts such as bonds and deferred taxes, liabilities are a big part of managing finances and calculating equity. This guide will help you understand how liabilities work and why they matter, whether you're improving your financial literacy or analyzing a company's financial reports.

Table of Contents

- What Are the Different Types of Liabilities?

- Current Liabilities: Short-Term Financial Responsibilities

- Long-Term Liabilities: Obligations Beyond One Year

- Special Liability Categories: Contingent, Legal, and Deferred

- How Liabilities Appear on the Balance Sheet

- Common Examples of Liabilities in Real-Life Contexts

- Understanding the Impact of Liabilities on Financial Health

- Conclusion

What Are the Different Types of Liabilities?

Read also:Mel Gibsons Net Worth In 2025 A Closer Look At His Wealth And Success

Alright, let’s talk liabilities. In simple terms, liabilities are anything you owe—whether it’s money, goods, or services. They can range from formal obligations like bonds to everyday ones like paying your utility bills. These financial responsibilities are categorized based on when they’re due.

Here’s the deal: liabilities are critical to understanding a business’s financial snapshot. When you subtract liabilities from assets, you get the owner’s equity, which gives you a clear picture of where the business stands financially. On a balance sheet, liabilities are always listed on the right side, directly opposite assets, reinforcing the dual structure of financial accounting.

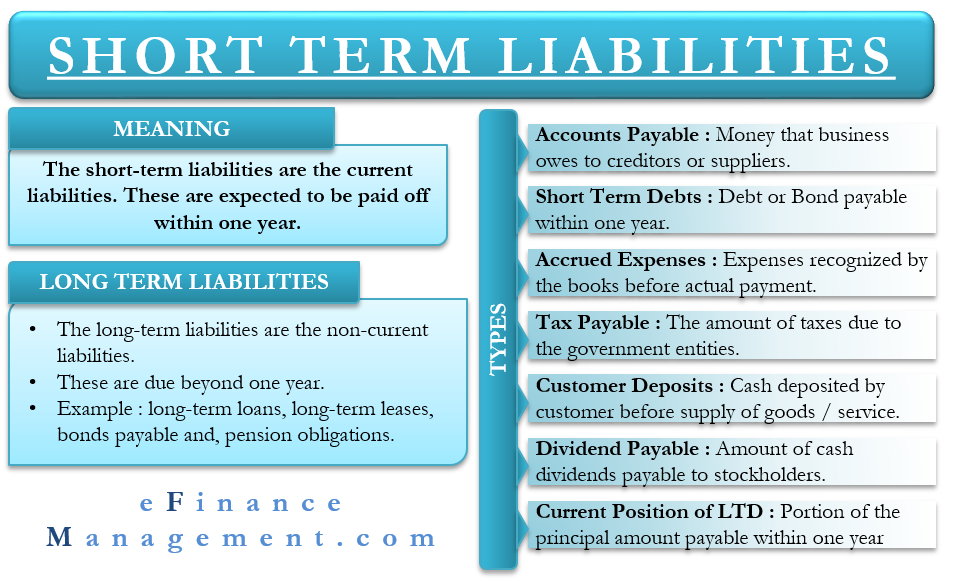

Current Liabilities: Short-Term Financial Responsibilities

Let’s dive into current liabilities. These are the financial obligations a company needs to settle within 12 months. They’re usually funded by current assets like cash or accounts receivable. Current liabilities are a great indicator of a company’s liquidity and operational health.

Here’s a breakdown of some common types:

- Accounts payable: This is when businesses owe money for products or services they’ve already received but haven’t paid for yet.

- Wages payable: This represents the total income earned by employees but not yet disbursed. It’s constantly changing, especially in companies that pay employees biweekly.

- Interest payable: This often arises from short-term credit usage.

- Dividends payable: This reflects declared but unpaid shareholder distributions.

- Unearned revenues: This happens when companies receive payment upfront but still owe a service or product.

For example, take dividends payable. Even though it’s considered an expense, it becomes part of current liabilities once it’s declared but not yet paid. It adds to the company’s short-term financial obligations. Another interesting one is deferred credits. While they technically represent revenue, they’re not yet earned and are treated as liabilities, showing that deferred credits are unearned income rather than active earnings.

Long-Term Liabilities: Obligations Beyond One Year

Now, let’s talk about long-term liabilities. Unlike short-term ones, these are due more than 12 months from now. They’re often tied to strategic decisions, like borrowing money to expand operations or build infrastructure.

Read also:Brad James Net Worth 2024 A Closer Look At His Wealth Career And Personal Life

Here are some examples:

- Bonds payable: Companies issue bonds in exchange for capital, essentially borrowing from investors.

- Mortgages: These are typically payable over extended periods, like 15 or 30 years. The portion due within the year is reported as a current liability.

- Deferred tax liabilities: These are postponed tax obligations due to differences in accounting methods.

- Post-employment benefits: Think pensions and healthcare coverage for retirees—liabilities that accumulate over time.

- Warranty liabilities: In manufacturing, these reflect the estimated future repair or replacement costs for sold products.

Take the automotive industry, for instance. Warranty liability is estimated based on the expected duration and cost of potential repairs. This estimate needs to be conservative enough to reflect real obligations without inflating future expenses too much.

Special Liability Categories: Contingent, Legal, and Deferred

Not all liabilities are straightforward. Contingent liabilities, for example, only show up based on the outcome of future events—like lawsuits, product recalls, or environmental fines. A company might not have an active obligation today, but the potential for financial risk is still there.

Similarly, legal liabilities arise from existing or potential litigation. Many companies carry liability insurance to protect themselves financially if a customer or employee brings a lawsuit.

Then there’s deferred credits, which get into the technical side of liabilities. These often involve customer advances or prepayments and must be carefully timed for revenue recognition. Only once the service is delivered does the company reduce the liability and record it as revenue.

These examples show how deferred revenue is collected before it’s earned and how liabilities can depend on future outcomes, like a court ruling or service delivery.

How Liabilities Appear on the Balance Sheet

On a balance sheet, you’ll find liabilities listed on the right side, clearly divided into current and non-current categories. This structure gives you a quick understanding of what the company owes now versus in the future.

This is where accounting logic comes into play: every financial decision fits into the equation assets = liabilities + equity. In other words, liabilities are just as important to a company’s financial structure as assets.

This alignment ensures that anyone analyzing the balance sheet—no matter their background or tools—can understand the company’s financial health.

Common Examples of Liabilities in Real-Life Contexts

Let’s bring this closer to home. When a restaurant owes its wine supplier for a recent delivery, that unpaid invoice is a liability on the restaurant’s books. Meanwhile, the wine supplier treats that same amount as an asset.

Think about your monthly mortgage—it has both a short-term and long-term component. The portion due this year is a current liability, while the rest is long-term.