Hey there! Have you ever wondered how much of your wealth you could actually tap into if an unexpected expense came knocking? That’s where the distinction between net worth and liquid net worth becomes crucial. While your overall net worth paints a broad picture of your financial standing, liquid net worth zeroes in on the cash you can access right away—something that can make all the difference in a pinch.

Think about it: if you’re managing your finances or helping someone else understand theirs, knowing the difference between these two concepts can help you make smarter decisions about planning for the future and securing your financial well-being. Let’s dive into this topic and break it down in a way that’s easy to grasp.

Table of Contents

Read also:Mark Gordons Journey A Look Into His 2025 Net Worth Wealth And Career Achievements

- What Is Liquid Net Worth and Why Does It Matter?

- How To Calculate Liquid Net Worth Accurately

- Breaking Down Liquid and Non-Liquid Assets

- Why Liquid Net Worth Should Be Your Financial Priority

- How Liabilities Affect Your Liquid Net Worth

- Smart Strategies to Boost Your Liquid Net Worth

- Common Pitfalls to Avoid When Assessing Liquid Net Worth

- Real-Life Scenarios That Highlight the Importance of Liquid Net Worth

- Final Thoughts on Liquid Net Worth

What Is Liquid Net Worth and Why Does It Matter?

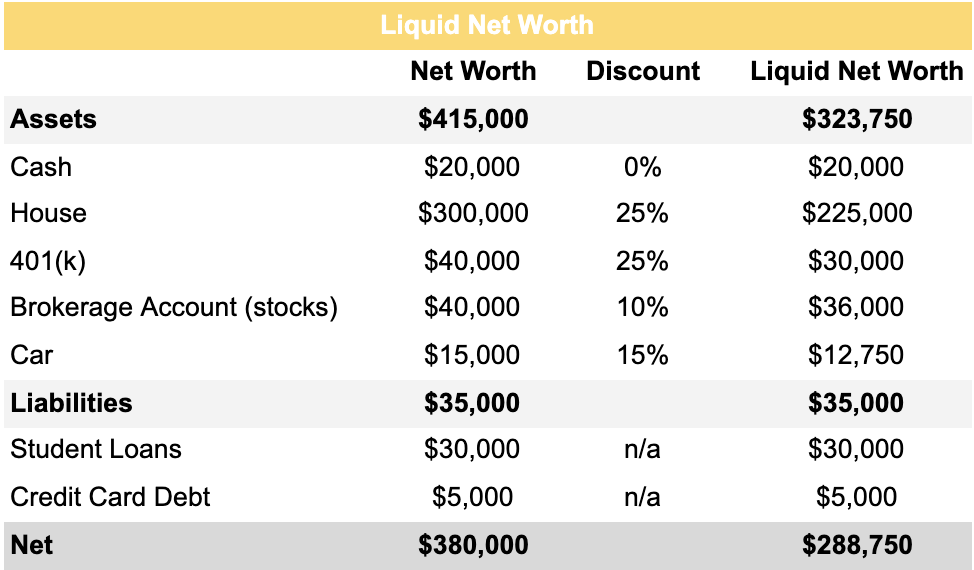

When we talk about net worth, we’re talking about the big picture: everything you own, like your house, car, jewelry, retirement accounts, and investments, minus everything you owe, such as mortgages, credit card balances, and loans. But liquid net worth? That’s a more focused view. It’s all about the assets you can quickly turn into cash without much hassle, like the money in your savings account, checking account, or stocks.

For instance, imagine someone with a high net worth because they own a luxury home or a collection of rare art. But if they can’t cover an unexpected medical bill or car repair tomorrow, their liquid net worth might be surprisingly low. That’s why understanding both numbers is important—but liquid net worth gives you a clearer idea of what you can actually use right now.

Here’s a quick breakdown:

- Liquid Assets: Cash, savings accounts, money market funds, stocks, bonds

- Non-Liquid Assets: Real estate, vehicles, retirement accounts with restrictions, collectibles

- Liabilities: Mortgages, credit card balances, student loans, any outstanding debt

Formula: Liquid Net Worth = Liquid Assets – Liabilities

So while your net worth tells you how wealthy you are on paper, your liquid net worth reveals how financially flexible you truly are.

Read also:Isaac Rochells Net Worth In 2025 A Closer Look At His Nfl Career Salary And Financial Insights

Now that we’ve got the basics down, let’s move on to how you can calculate your liquid net worth accurately.

How To Calculate Liquid Net Worth Accurately

Figuring out your liquid net worth doesn’t have to be complicated, but precision is key. Start by listing all your liquid assets. These might include:

- Cash you have on hand

- Your checking and savings accounts

- Your stocks, ETFs, and mutual funds

- Any short-term investments

Next, subtract all your liabilities. Be thorough and don’t forget to include:

- Your credit card debt

- Car loans

- Student loans

- Your current mortgage balance

Feeling like you need to add some non-liquid assets, like a valuable piece of jewelry or a car? Go ahead, but apply the 80% rule. This means you discount the estimated value by 20% to account for fees, market conditions, or other factors that could affect the sale price.

Breaking Down Liquid and Non-Liquid Assets

Liquid assets are your go-to resources when life throws you a curveball. They’re:

- Quickly accessible

- Easily converted to cash

- Stored in accounts you can tap into at a moment’s notice

On the other hand, non-liquid assets take time and effort to sell—and sometimes you might even lose money in the process. These include:

- Property and land

- Vehicles

- Collectibles like art or vintage items

- Retirement accounts that come with age restrictions or penalties for early withdrawal

Grasping this difference is essential for building financial flexibility and preparing for whatever life throws your way.

Why Liquid Net Worth Should Be Your Financial Priority

Liquid net worth plays a critical role in:

- Handling emergencies with confidence

- Ensuring you always have quick access to cash

- Getting a realistic view of your financial health

- Preparing for unexpected events like job loss or medical expenses

If you’re serious about managing your money, knowing your liquid net worth gives you a clear picture of what you can actually use right now—not just what’s on paper.