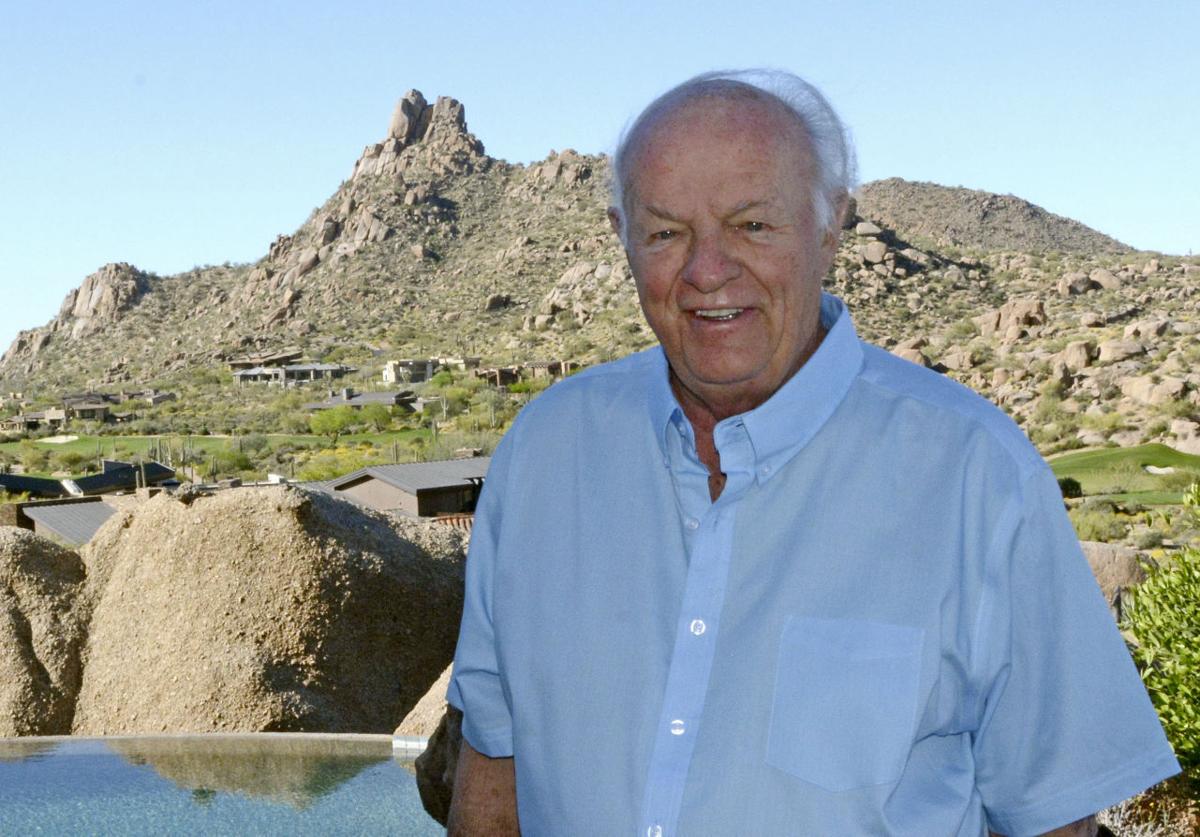

Ever heard of someone who wants to die broke? That’s the surprising goal of Denny Sanford, a man whose name has become synonymous with both massive wealth and extraordinary generosity. Denny Sanford’s net worth in 2025 remains a topic of intrigue, especially given his unconventional path to riches and his bold commitment to giving it all away.

Let’s dive into the world of Denny Sanford, a man whose fortune is deeply rooted in the subprime credit card industry and whose generosity has left a lasting impact on healthcare, education, and research. His journey is not just about making money—it’s about how he plans to give it all back to the world.

Table of Contents

Read also:Art Bells Net Worth In 2025 A Deep Dive Into His Wealth Salary And Financial Legacy

Denny Sanford: The Man Behind the Money

| FACT | DETAIL |

|---|---|

| Real Name | Thomas Denny Sanford |

| Popular Name | T. Denny Sanford |

| Birth Date | December 23, 1935 |

| Age | 89 (as of 03/25/2025) |

| Birthplace | Saint Paul, Minnesota, USA |

| Nationality | American |

| Ethnicity | Swedish descent |

| Education | University of Minnesota (Psychology) |

| Marital Status | Divorced |

| Spouse | Anne (1960–1982), Colleen Anderson (1995–2005) |

| Children | 2 sons |

| Dating | N/A |

| Siblings | N/A |

| Parents | Edith Sanford |

| Height (meters) | N/A |

| Net Worth | $2.1 billion |

| Source of Wealth | Dividends from First Premier Bank, Subprime Credit Cards |

How Much Is Denny Sanford Worth in 2025?

As of March 24, 2025, Denny Sanford is estimated to have a net worth of $2.1 billion. That’s right—$2.1 billion. He ranks as the 1,646th richest person in the world, but his wealth isn’t tied to tech startups, real estate empires, or even Hollywood blockbusters. Instead, it comes from a niche corner of the financial world: subprime lending. Denny Sanford quietly built his fortune through First Premier Bank, a financial institution that issues high-interest credit cards to borrowers who often have limited options. It’s not the most glamorous business model, but it’s undeniably profitable. Most of his earnings come in the form of dividends, which he uses not just for personal gain but also to fund his massive philanthropic efforts.

While other billionaires might be busy building rockets or designing the next big app, Denny Sanford’s wealth is rooted in the everyday financial struggles of millions of Americans. His approach might not be flashy, but it’s certainly effective. Let’s take a closer look at the financial institutions and organizations that have played a key role in his journey:

- First Premier Bank

- United National Corporation

- Premier Bankcard

- Sanford Health

- Sanford Underground Research Facility

- The Giving Pledge

- Forbes

- National University

- Arizona State University

- University of Minnesota

Denny Sanford’s Financial Empire: How It Works

The Foundation of His Wealth: First Premier Bank

Denny Sanford’s financial empire is built on a foundation of unconventional thinking. He owns First Premier Bank, a financial institution that specializes in issuing high-interest credit cards to subprime borrowers. Despite having just 17 branches, the bank manages to issue a staggering number of Mastercards to individuals with low credit scores. This makes it one of the largest credit card issuers in the U.S., even if it doesn’t have the glitz and glamour of Wall Street. Sanford’s strategy is simple yet effective: serve a market that others often overlook. By focusing on subprime lending, he taps into a lucrative niche that generates consistent revenue through fees and

Read also:Cristela Alonzos Journey Net Worth Career And Beyond