Let’s talk about the top 1 percent. What does it really take to be part of this exclusive club? It’s not just about having a big paycheck—it’s about building a massive nest egg that sets you apart from 99% of the world. Today, we’re diving into what it means to have a net worth that qualifies you for this elite group.

Here’s the scoop: To join the top 1 percent, your net worth needs to hit at least $13.7 million. And guess what? These folks don’t just have money—they own a ton of equities, real estate, and private ventures. Their influence goes way beyond dollars and cents—it shapes policies, investment trends, and generational wealth. In this article, we’re breaking down how they got there, how they keep their wealth growing, and what separates them from the rest of us. Let’s get started.

Table of Contents

Read also:Kourtney Kardashians Net Worth In 2025 A Deep Dive Into Her Wealth Salary And Financial Insights

- How Much Wealth Do You Need to Be in the Top 1 Percent?

- Who Are the Faces Behind the Top 1 Percent?

- How Is Wealth Distributed Among the Top 1 Percent?

- Why Is the Wealth Gap So Extreme?

- What Role Do Taxes Play in Wealth Building?

- Which Industries Are Driving Top 1 Percent Growth?

- How Does the Top 1 Percent Shape Society?

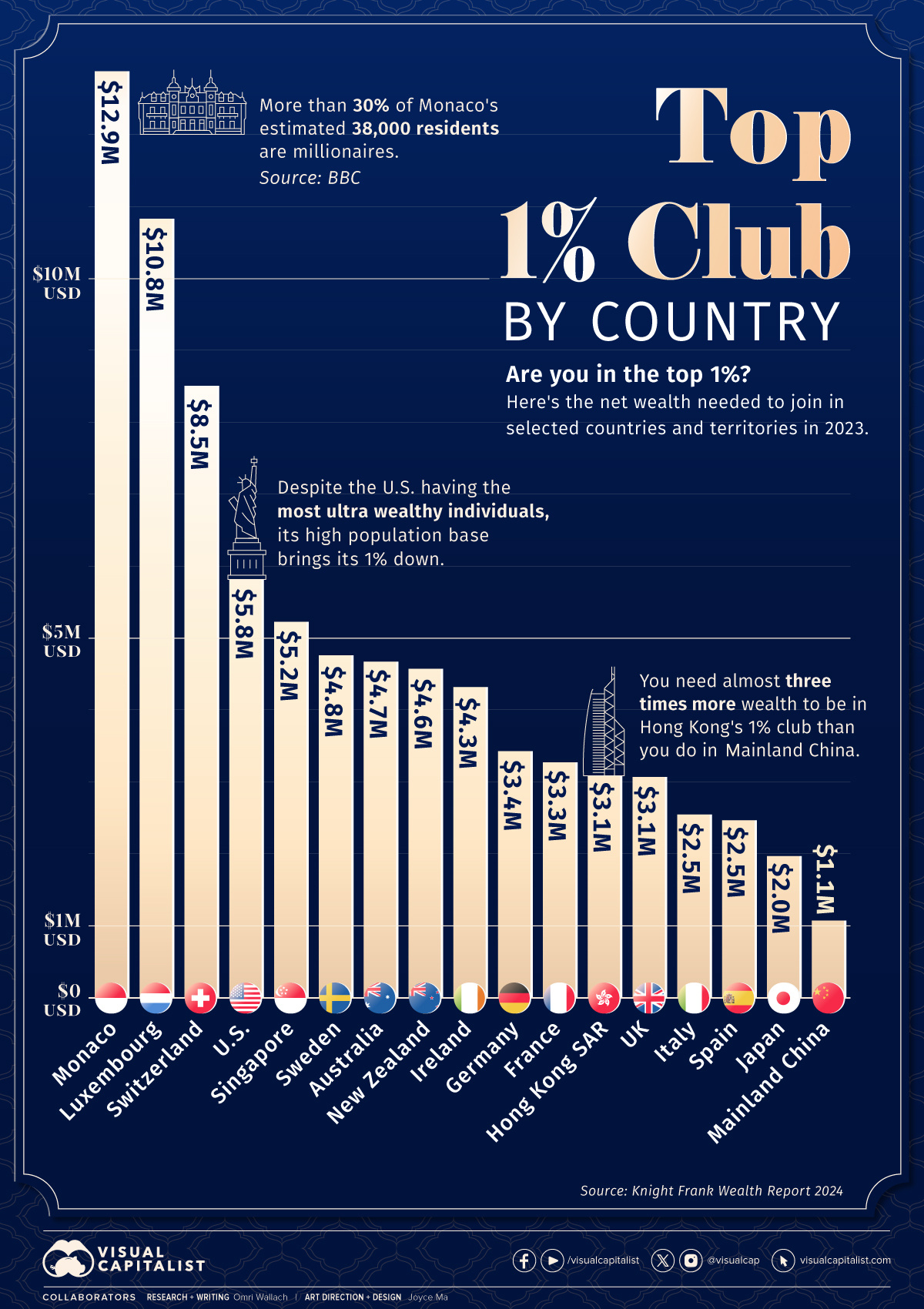

- How Does the U.S. Compare Globally?

- Is It Harder or Easier to Join the Top 1 Percent?

- Final Thoughts

How Much Wealth Do You Need to Be in the Top 1 Percent?

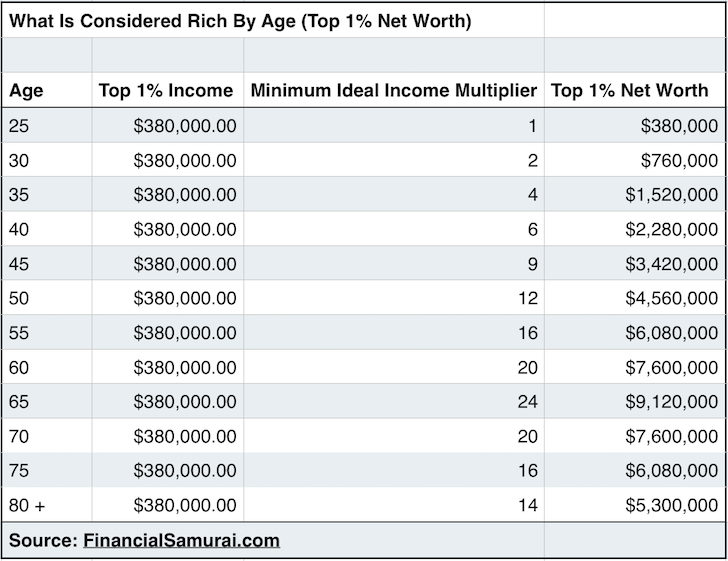

Alright, here’s the deal: To officially join the top 1 percent in terms of net worth in the U.S., you need a household net worth of at least $13.7 million. But wait, there’s more. If you’re looking at income alone, an individual needs to bring in around $407,500 per year, while households need to earn at least $591,550 annually. That’s right—these numbers are astronomical compared to the average American.

But it’s not just about how much you earn. It’s about what you own. The top 1 percent doesn’t just rely on salaries—they own massive amounts of stocks, real estate, and business equity. For instance, they control over 50% of all equity shares in both private and public companies. This means that their wealth isn’t just sitting in a bank account—it’s actively growing through smart investments.

Now, let’s put this into perspective. The top 10 percent of Americans have a net worth starting at $1.9 million. That’s a big difference from the top 1 percent, but still impressive. The IRS reports that this wealthy group pays around 40% of all federal income taxes, despite earning only 22% of the total adjusted gross income. That’s a pretty significant financial contrast, don’t you think?

Who Are the Faces Behind the Top 1 Percent?

When you think of the top 1 percent, you might picture tech billionaires or Wall Street titans. But the truth is, this group includes a wide range of people—doctors, entrepreneurs, corporate executives, and even those who inherited their wealth. One thing they tend to have in common? A knack for owning assets that appreciate in value.

Take Elon Musk, for example. With a net worth of $428 billion, he’s the richest person on the planet. His rise to the top is a testament to how combining income and strategic asset ownership can lead to astronomical wealth. Globally, there are 2,781 billionaires who collectively own over $14.2 trillion. These numbers are mind-blowing, and they highlight just how powerful this group really is.

Read also:Dylan Obriens Net Worth In 2025 A Closer Look At His Financial Journey

How Is Wealth Distributed Among the Top 1 Percent?

The secret sauce for the top 1 percent? Asset ownership. While most people rely on wages, the ultra-wealthy grow their money through investments, especially in stocks and equity. According to the Economic Policy Institute, back in 1962, the top 1 percent had 125 times the average household’s net worth. By 2009, that number skyrocketed to 225 times. That’s a massive increase over just a few decades.

Today, billionaires control $14.2 trillion, and Elon Musk alone has a net worth of $428 billion. Many of these ultra-wealthy individuals invest in hedge funds, private equity, and take advantage of stock buybacks to boost shareholder value. It’s not uncommon for them to reinvest their capital gains into ventures that keep generating more wealth.

Why Is the Wealth Gap So Extreme?

Let’s talk about why the gap between the top 1 percent and everyone else is so enormous. Between 1979 and 2020, wages for the top 1 percent increased by a staggering 160%, while the bottom 90% only saw a 31% increase. That’s a huge disparity, and it’s only getting worse.

The middle class has been hit hard, especially since 2000. While the top 1 percent continues to earn through investments, the rest of us are stuck with stagnant wages. The Economic Policy Institute reports that the middle-class wealth curve has barely moved since the early 2000s, highlighting a growing financial divide that doesn’t seem to be slowing down anytime soon.

What Role Do Taxes Play in Wealth Building?

Taxes—or more specifically, tax advantages—are a big part of how the top 1 percent maintains their wealth. As of 2025, the estate tax exemption has risen to $13.99 million, allowing the wealthy to pass on enormous assets without losing much to taxes. This means that wealth can be transferred generationally with minimal loss.

Through strategic planning and legal tools, many in the top 1 percent leverage gift exemptions, favorable capital gains treatments, and estate planning to preserve their wealth over time. The Inflation Reduction Act, passed in 2022, introduced a 1% stock buyback tax and a 15% minimum corporate tax to address corporate loopholes. However, the debate over fair taxation continues, with figures like Elizabeth Warren and Bernie Sanders advocating for stricter measures.

Which Industries Are Driving Top 1 Percent Growth?