Ever wondered if you're part of the financial elite? You're not alone. Many people are curious about their place in today's wealth hierarchy and what it takes to break into the top 2 percent net worth. It’s not just about having a few investments or owning a home—it’s about understanding your full financial picture and how your assets compare to others.

In this article, we’ll break down exactly how much wealth you need to reach that milestone, what defines financial standing among the wealthiest, and how smart investment decisions can help you climb the ranks. Let's dive in and see where you stand.

Table of Contents

Read also:Amy Grants Net Worth 2025 The Untold Story Of Her Success

- How Much Do You Need to Be in the Top 2 Percent?

- What Defines Financial Standing Among the Wealthiest?

- How Do Your Wealth and Financial Decisions Reflect This Rank?

- How Do You Compare With Others in Top Percentiles?

- What Investment Patterns Do the Top 2 Percent Follow?

- How Are Younger Individuals in This Group Managing Their Finances?

- Why Do Many in This Group Turn to Philanthropy?

- What Practical Steps Can You Take to Reach This Level?

- Conclusion

How Much Do You Need to Be in the Top 2 Percent?

To crack the top 2 percent of net worth in America by 2025, you’ll need around $2.7 million. That’s not just a random number—it’s the line that separates the financially elite from the rest. So, where do you stand right now?

You might feel wealthy if your net worth is close to $2.2 million, which is what many Americans say defines feeling rich, according to the Schwab Modern Wealth Survey. But the actual number to join the top 2 percent is higher and continues to grow as wealth inequality expands. The good news? Once you understand your financial balance sheet—assets versus liabilities—you can take actionable steps toward achieving this milestone.

What Defines Financial Standing Among the Wealthiest?

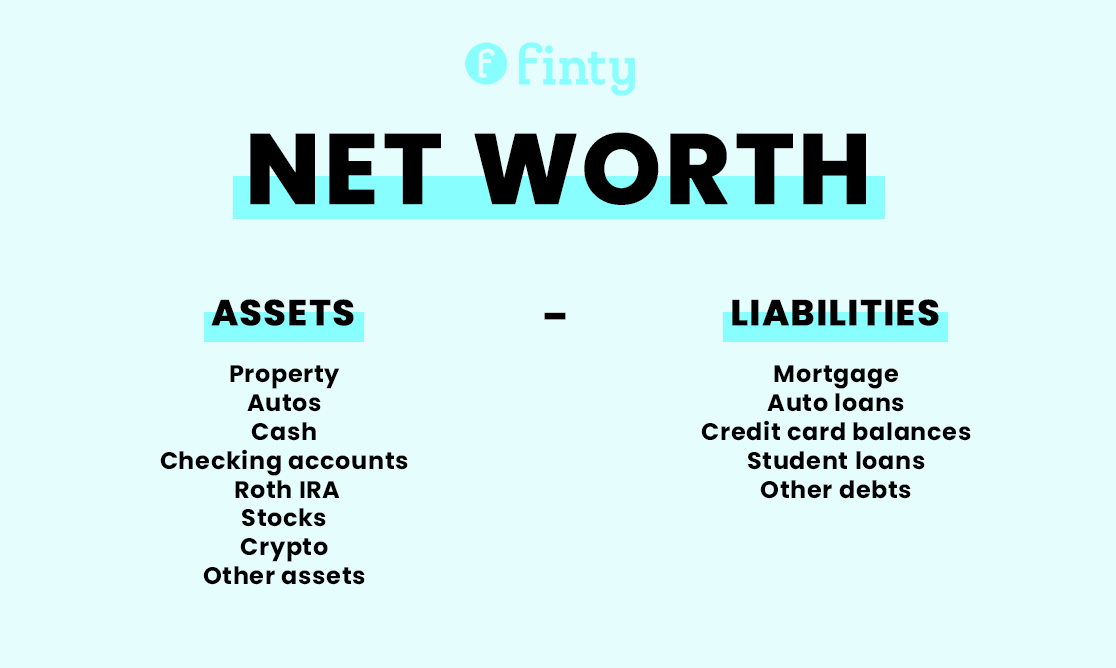

Your financial standing isn’t just about income; it’s about what you truly own after subtracting what you owe. Here’s how you can calculate your net worth:

- Assets: Cash, savings, investments, retirement accounts, real estate, and valuable possessions.

- Liabilities: Mortgages, car loans, student debt, credit card balances, and any other financial obligations.

In simple terms, your net worth = total assets – total liabilities. If your assets include property and savings, and your liabilities consist of debt and loans, you’re already on the right track. Understanding this equation helps you gauge your wealth percentile and see how close you are to joining the top bracket.

How Do Your Wealth and Financial Decisions Reflect This Rank?

Once you’re near or already in the top 2 percent, your wealth decisions take on a new dimension. You don’t just save—you invest strategically. Here’s how a typical top-tier portfolio might look:

Read also:Michael Strahans Net Worth In 2025 A Closer Look At His Wealth And Success

| Investment Type | % of Portfolio |

|---|---|

| Real Estate (Primary/Secondary) | 32% |

| Equities (Stocks) | 18% |

| Commercial Property | 14% |

| Bonds | 12% |

| Private Equity/Venture Capital | 6% |

| Luxury Assets (e.g., Art) | 5%+ |

High-net-worth individuals put their money to work. They invest in real estate, spread their funds across equities and bonds, and explore high-growth assets like private equity. Some even dabble in luxury assets—art, for example, increased in value by 29% last year alone. It’s all about diversification and finding opportunities for long-term growth.

How Do You Compare With Others in Top Percentiles?

How do you stack up against others in the top percentiles? Let’s break it down:

- Top 1%: $11.6 million

- Top 2%: $2.7 million

- Top 5%: $1.17 million

- Top 10%: $970,900

- Median Net Worth (All Families): $192,900

- Mean Net Worth: $1,063,700

These numbers show the vast differences in wealth thresholds across the population. If you’re above $1 million, you’re already within the top 10 percent. But every step higher comes with greater complexity—and opportunities for growth.

What Investment Patterns Do the Top 2 Percent Follow?

Breaking into the top 2 percent—or staying there—requires more than just basic savings. You need a strategic investment approach. Here’s what the top 2 percent typically invest in:

- Real estate: A core asset for stability and long-term appreciation.

- Equities: Stocks for long-term growth potential.

- Commercial property: For steady, predictable returns.

- Bonds: For stability and lower risk.

- Private equity or startups: High-risk, high-reward opportunities.

- Art or collectibles: For portfolio diversification and unique investment