Hey there, friend! Have you ever stopped to think about what kinds of assets you really own—and what they’re truly worth? Whether you're managing your personal finances or steering the ship of a business, understanding the different types of assets can be a game-changer. It’s not just about knowing what you have; it’s about making those assets work for you.

From cash in your pocket to long-term investments like buildings or machinery, every asset plays a role in your financial health. This guide will walk you through what assets are, how they’re classified, and why they matter—explained in a way that feels like we’re having a conversation over coffee.

Table of Contents

Read also:Reggie Jacksons Net Worth In 2024 A Closer Look At His Career And Financial Success

- What Exactly Are Assets, and Why Should You Care?

- Current Assets: The Short-Term Powerhouses

- Fixed Assets: The Long-Term Heavy Lifters

- Financial Assets: Investments That Keep You Ahead

- Intangible Assets: The Invisible Giants

- How Assets Appear on Financial Statements

- Real-World Examples of Personal and Business Assets

- Managing and Valuing Your Assets Over Time

- The Tangible vs. Intangible Debate

- Assets vs. Liabilities: What's the Big Deal?

- Final Thoughts on Asset Management

- Wrapping It All Up

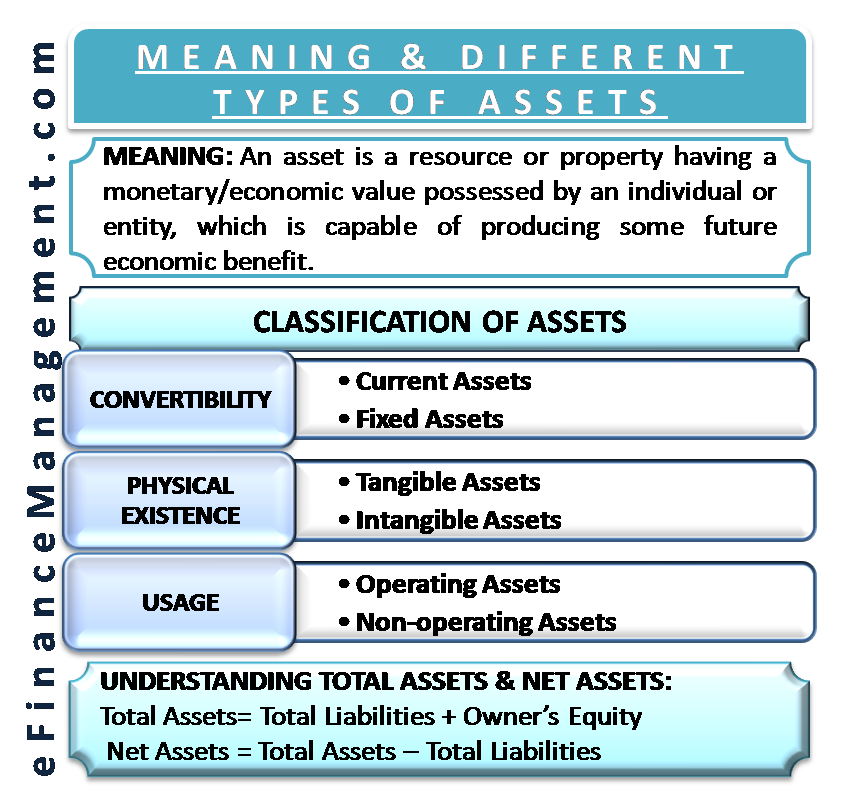

What Exactly Are Assets, and Why Should You Care?

Here's the scoop: Assets are anything that you own or control that’s expected to bring in some kind of economic benefit in the future. That could mean generating cash, reducing costs, or even boosting revenue. But here's the key—just having stuff doesn’t make it an asset. It has to create value for you. When businesses report their assets, they’re not just listing random items. They’re showing how these resources contribute to their financial position.

Current Assets: The Short-Term Powerhouses

Current assets are the quick-hitters—resources that are either cash or can be turned into cash within a year. Think of them as your everyday workhorses. They keep the wheels turning in your day-to-day operations.

- Cash: This is the ultimate liquid asset. It’s always ready to meet your immediate needs, whether it’s paying bills or seizing an opportunity.

- Accounts Receivable: This represents money owed to you. But here’s the catch—businesses need to reassess these periodically to make sure they’re actually collectible.

- Inventory: This is a big one for businesses. It’s the lifeblood of operations, but if it becomes outdated, you might need to adjust its value. After all, nobody wants to sell last season’s goods at a discount.

Together, these items give businesses the flexibility and speed they need to thrive. For example, inventory isn’t just about having products on the shelf—it’s about having the right products ready to sell. Similarly, when accounts receivable are reported on a balance sheet, they act as a bridge between delivering a product and getting paid for it.

Fixed Assets: The Long-Term Heavy Lifters

Fixed assets are the long-term players in your financial game. These aren’t for sale—they’re meant to be used over several years to keep your business running smoothly.

- Buildings: These big-ticket items lose value over time through depreciation, often calculated using the straight-line method.

- Machinery: This is the backbone of many businesses. Machinery typically has a useful life of around 7 years and gradually wears out with usage.

- Vehicles: From company cars to delivery trucks, vehicles are assigned a 5-year lifespan under IRS guidelines. Knowing this helps businesses plan for replacements.

These assets stay on the books longer and gradually depreciate, impacting both taxes and long-term planning. For instance, IRS guidelines help businesses accurately forecast when it’s time to replace vehicles. Similarly, buildings undergo depreciation, which helps balance their long-term value on financial records.

Read also:Cj Strouds Net Worth In 2025 A Closer Look At His Financial Journey

Financial Assets: Investments That Keep You Ahead

Financial assets are all about paper or digital investments that hold monetary value. These can be traded and often include:

- Bonds: Known for their stability and reliability, bonds are a favorite for those seeking predictable income.

- Mutual Funds: Offering diversification and ease of trading, mutual funds are a popular choice for investors looking to spread their risk.

- Stocks: Whether issued by corporations or governments, stocks represent ownership in an entity and are key for capital gains.

These assets don’t stay static—they fluctuate based on market conditions. That’s why they’re often valued at the current market price, not the historical cost. A company might hold bonds as financial assets for stable income, while stocks represent ownership and are vital for growth.

Intangible Assets: The Invisible Giants

Intangible assets may not have a physical form, but they pack a serious punch when it comes to boosting a company’s worth. Think about trademarks—they can skyrocket a brand’s visibility. Or patents, which provide long-term protection and a competitive edge.

- Goodwill: Often arising from business acquisitions, goodwill reflects the extra value a company brings to the table.

- Copyrights: These secure intellectual rights, ensuring creators are protected.

- Royalties and Brand Equity: While