Hey there, friend. Ever stopped to think about what your true financial worth really is? In the world of money, understanding the difference between net worth and gross worth isn’t just about crunching numbers—it’s about knowing where you stand financially. Let’s dive into this together.

Gross worth is basically the grand total of what you’ve got before you start subtracting things like debts or expenses. Think of it as your income or assets before you take out the trash, so to speak. On the flip side, net worth is the real deal. It’s what’s left after you’ve accounted for all your liabilities—things like loans, credit card balances, and other financial obligations.

For instance, imagine someone pulling in $100,000 a year. That’s their gross income. But once you factor in taxes, student loans, and credit card payments, the number that’s left is their net income. That final figure is what really tells the story of their financial health.

Read also:Tom Homan Net Worth 2025 Inside The Numbers Behind His Career And Finances

Knowing the difference between these two concepts doesn’t just help you understand where you’re at today—it gives you insight into how your financial decisions will impact your future. So, let’s break it down and make sense of it all.

Table of Contents

- How to Calculate Gross Worth

- Common Misconceptions About Gross and Net Worth

- Why Understanding Gross and Net Worth Matters for Financial Planning

- Gross vs Net: Which Metric Should You Focus on?

- How Business Owners Can Track Gross and Net Worth Effectively

- Key Factors That Affect Gross and Net Worth Over Time

- Tools and Resources to Help You Measure Worth Accurately

- Conclusion

How to Calculate Gross Worth

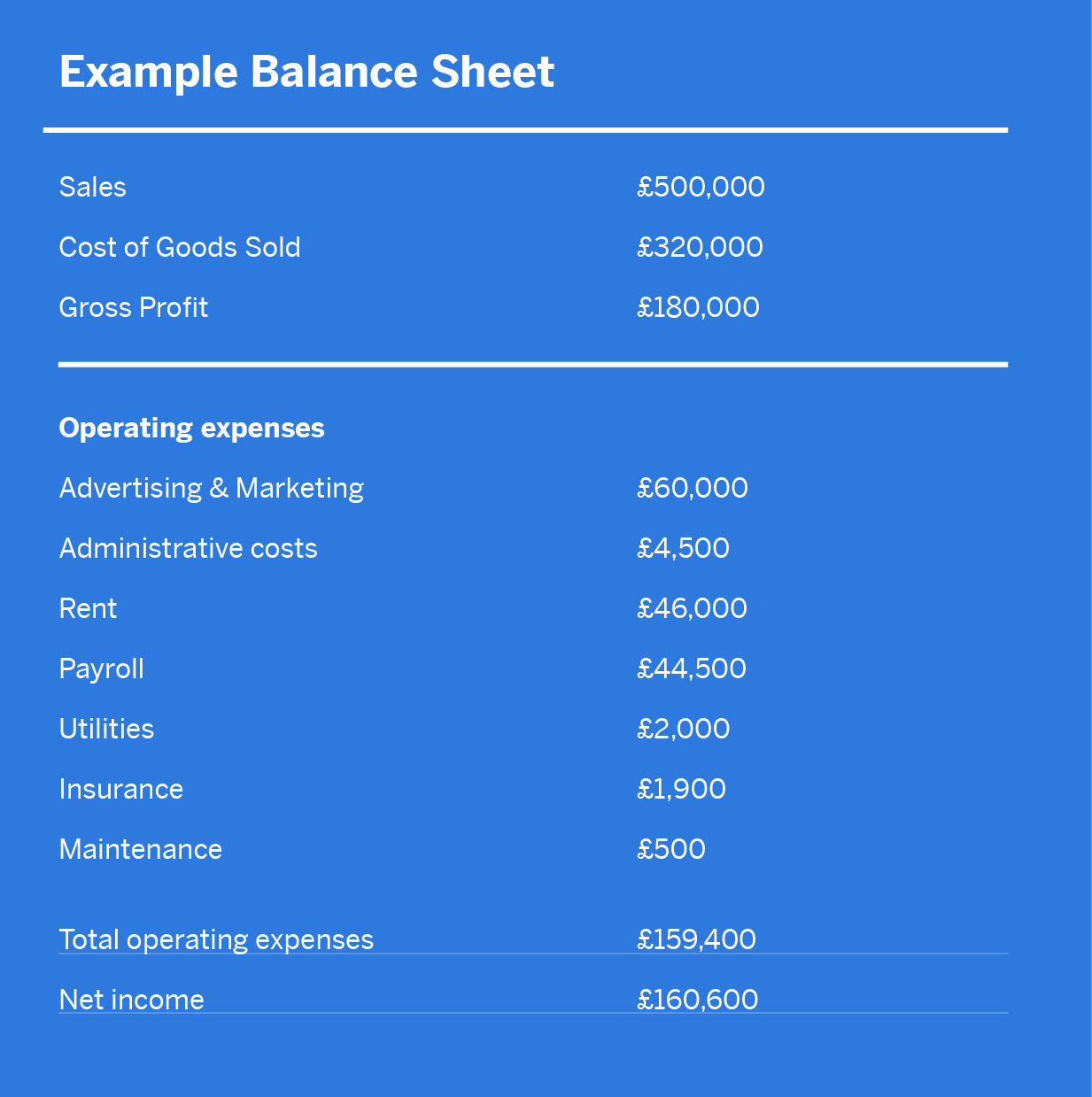

Alright, let’s talk about gross worth. This is the big picture number—the one that shows everything you’ve got before you start subtracting expenses. Think of it as the total revenue you generate in a given period, whether it’s your annual salary, investment returns, side hustles, or even the value of your property. For example, if a business earns $90,000 from clients in a year, that’s its gross income. No deductions, no expenses—just the raw number.

This figure is super useful for evaluating growth potential. It gives you a snapshot of how much revenue you’re generating without worrying about the costs. Whether you’re an individual or a business, tracking gross worth over time can help you understand how well you’re doing in terms of income generation. However, it’s important to remember that gross worth doesn’t tell the whole story. It doesn’t factor in expenses or liabilities, so while it’s a great starting point, it’s not the final word on your financial health.

Common Misconceptions About Gross and Net Worth

Let’s clear up a common misunderstanding right off the bat. A lot of people think that earning more automatically means being wealthier. But here’s the thing: while gross worth shows the total income you bring in before deductions, it doesn’t give you the full picture of what’s actually available to spend or save. For example, you might make $200,000 a year, but if most of that goes toward living expenses, debt repayments, and taxes, your financial cushion isn’t as big as it looks on paper.

Read also:Mario Carbones Net Worth In 2024 A Closer Look At His Culinary Empire

This is where the distinction between gross and net income becomes crucial. Gross income tells you how much you’re earning in total, but net income shows you what’s left after all the costs are taken out. Net worth goes a step further by factoring in liabilities, giving you a much clearer understanding of your overall financial stability. Too often, people focus only on what they earn and forget about what they owe, which can lead to a distorted view of their wealth.

Why Understanding Gross and Net Worth Matters for Financial Planning

When it comes to making decisions about your money, clarity is key—not just big numbers. Knowing the difference between net worth and gross worth helps you set realistic goals and make informed plans. Whether you’re saving for retirement, managing credit, or planning to buy a home, your net income is the number that really matters because it reflects the actual profit you can use or reinvest.

Business owners need to understand this distinction too. A company might have impressive gross revenue, but if operational costs are too high, it could still be losing money. Net income shows how much money a business actually makes after accounting for all its expenses and deductions. Having this knowledge allows for smarter planning, whether you’re an entrepreneur or just managing your personal finances.

This level of clarity is essential. It makes financial decisions easier when you know whether you’re growing or just maintaining. While assets contribute to your overall wealth, liabilities can drag down your total net worth. Understanding this balance helps you see whether you’re moving forward or just treading water.

Gross vs Net: Which Metric Should You Focus On?

It depends on what you’re trying to achieve. If you’re negotiating a salary or evaluating your business’s sales performance, gross figures are crucial. But if you’re trying to understand your personal wealth, net figures are what really matter.

Think about it this way: a business might bring in a ton of gross income, but if the operating costs are too high, it could still end up in the red. Expenses directly impact net income, which is why gross income shows potential revenue, but net income reveals your true financial position. If you’re planning for long-term goals like retirement or investments, focus on net worth. It gives you the clearest insight into what you actually have to work with.

How Business Owners Can Track Gross and Net Worth Effectively

For entrepreneurs, keeping tabs on both gross and net numbers is absolutely essential. Gross income shows how much is being earned, while net income takes business expenses into account and highlights profit. Businesses generate gross income through the services or products they sell, but they also incur expenses like payroll, equipment, and marketing costs.

By monitoring both figures, you can identify unnecessary spending, assess pricing strategies, and forecast cash flow more accurately. Financial reports often break this down in income statements, giving you an overview of how income and deductions balance out. Understanding how deductions lower taxable income can also help business owners plan smarter during tax season. With better insight, it’s easier to adapt and improve financial outcomes.

So, how much do you need to be in the top 10 percent? Find out here.

Key Factors That Affect Gross and Net Worth Over Time