Here’s the million-dollar question: Can someone with a million dollars still feel trapped? The answer lies in understanding the true distinction between net worth and wealth. It's not just about how much you have; it's about how you use it.

Let’s break it down: A high net worth might sound impressive, but if that money is tied up in assets you can’t touch or isn’t generating income, it doesn’t translate to freedom. At Pennbook Center, we’re all about helping you see beyond the numbers and focus on what really matters—having money work for you, not the other way around. In this article, we’ll explore what wealth truly means, how it differs from net worth, and how to align your finances with your personal freedom.

Table of Contents

Read also:Hoziers Net Worth In 2025 The Inside Story Of His Financial Success

- What’s the Real Deal Between Net Worth and Wealth?

- Why Wealth Is More Than Just Numbers

- How to Measure Wealth in Real Life

- The Magic of Passive Income

- Why Liquidity Matters When Building Wealth

- Case Studies: Who’s Truly Wealthier?

- Turning Net Worth Into Real Wealth

- Can You Be Wealthy Without a High Net Worth?

- Final Thoughts

What’s the Real Deal Between Net Worth and Wealth?

Here’s a common misconception: A high net worth equals financial security. But guess what? That’s not always the case. Net worth is essentially the difference between what you own (assets) and what you owe (liabilities). It’s like taking a quick snapshot of your financial picture at a single moment in time.

On the flip side, wealth goes deeper. It’s not just about how much money you have—it’s about how much freedom that money provides. Net worth measures value, but wealth measures how useful that value is in your everyday life.

Picture this: You know someone with a big house, a fancy car, and a hefty 401(k). On paper, they look wealthy. But if most of that money is tied up in assets they can’t easily access without penalties or selling off their possessions, they might actually be struggling with cash flow. That’s where understanding the difference between net worth and wealth becomes crucial.

Why Wealth Is More Than Just Numbers

Here’s a fun way to think about wealth: It’s often best understood through the lens of financial freedom. How long could you maintain your current lifestyle without actively working? That’s the real test of wealth. One key idea here is that wealth isn’t measured just in dollars—it’s measured in time.

Imagine two people. One has millions invested in retirement accounts but no cash-flowing assets. The other has a more modest net worth but earns enough passive income to cover all their expenses. In this case, the second person is truly financially free because passive income reduces the need for active employment.

Read also:Leslie Jones Net Worth 2025 Unpacking Her Wealth And Financial Success

While the first person may seem richer, they’re not necessarily wealthier. That’s the power of financial usability. Wealth isn’t just about having more—it’s about having more usable resources.

How to Measure Wealth in Real Life

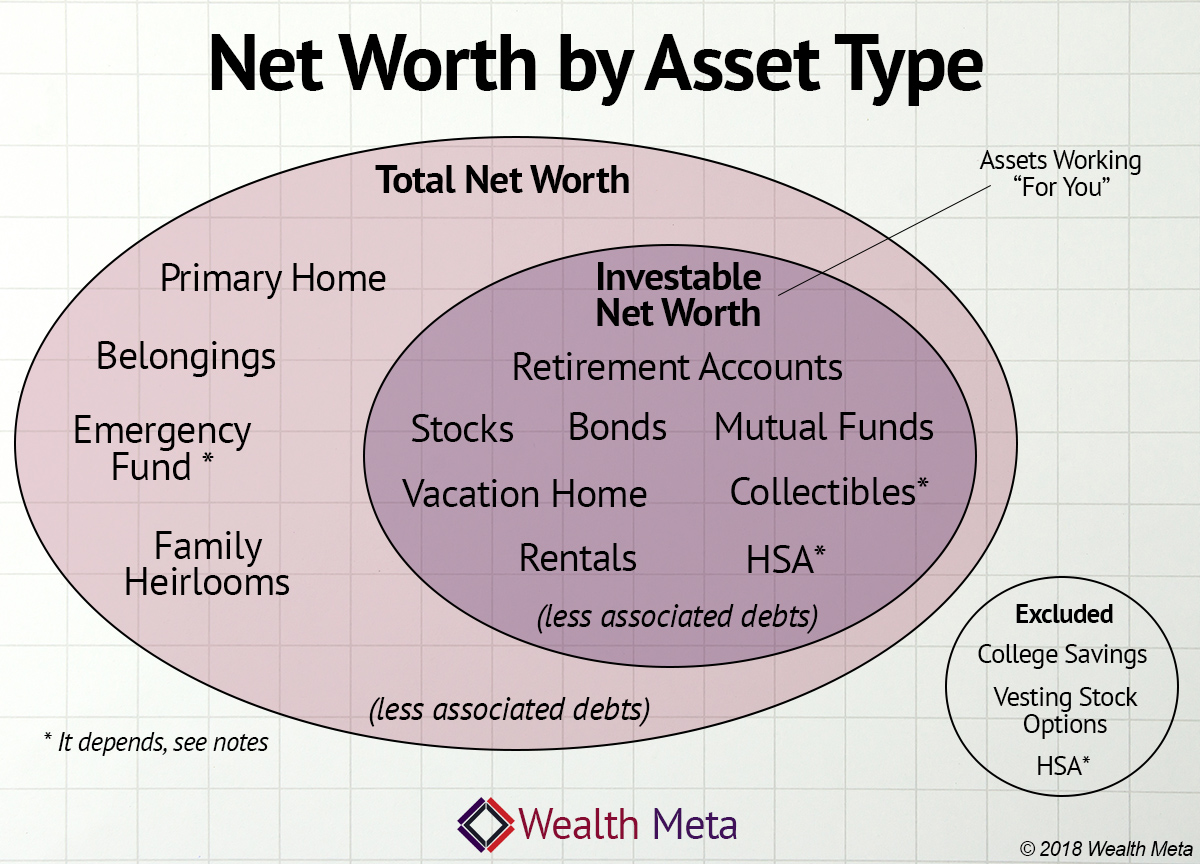

Net worth is a great tool for tracking progress, but it has its limits. Many people calculate their net worth based on assets that aren’t easily converted to cash, like their home, retirement savings, or collectibles.

These assets, while valuable, come with access restrictions. Selling a house isn’t quick or easy, and withdrawing from a retirement account might lead to taxes and penalties. In short, net worth includes illiquid assets that don’t always help with day-to-day expenses.

Now, compare that with someone who generates consistent income from investments. For example, earning $10,000 per month in passive income means they can live comfortably without ever touching their net worth. That’s a practical definition of wealth—one that focuses on usability rather than just accumulation.

The Magic of Passive Income

Here’s the secret sauce of financial freedom: passive income. This kind of income comes from sources that don’t require daily effort, like rental properties, dividends, or side businesses. It’s like having money work for you while you sleep.

These cash-flowing assets contribute to wealth by creating a consistent income stream. The more you rely on these sources, the less you need to depend on earned wages. Over time, this shift in income structure produces steady income and increases financial flexibility.

When someone’s lifestyle is funded by these income-generating assets, they’re no longer tied to a paycheck. That’s when net worth becomes truly functional. It’s not just a number—it’s a lifeline to freedom.

Why Liquidity Matters When Building Wealth

It’s easy to be impressed by someone’s million-dollar home or seven-figure retirement account, but here’s the catch: Those assets can’t easily be spent. Liquidity matters. You need cash or quickly accessible funds to pay for daily expenses.

Many high-net-worth individuals are actually asset-rich but cash-poor. Their money is tied up in things that can’t be sold or accessed easily. This is why liquid assets increase accessible income and make a person truly wealthy.

The takeaway? Net worth tells one story; income usability tells the full story. Focus not just on what you own, but on what you can use. After all, money that’s out of reach isn’t much help in the here and now.

Case Studies: Who’s Truly Wealthier?