Hey there! Let’s break it down: Do you truly understand the different types of liabilities that shape your financial picture or your business’s bottom line?

From those pesky short-term bills that stack up, like utility payments and employee wages, to those long-term commitments, like mortgages or deferred taxes, liabilities are a big part of how we manage our money. Whether you're brushing up on financial literacy or diving deep into corporate financial statements, this guide will help you make sense of it all. Stick around, and let’s get into it.

Table of Contents

Read also:Jayden Maiavas Journey From College Gridiron To Financial Success

- What Are the Different Types of Liabilities?

- Current Liabilities: Short-Term Financial Responsibilities

- Long-Term Liabilities: Obligations Beyond One Year

- Special Liability Categories: Contingent, Legal, and Deferred

- How Liabilities Appear on the Balance Sheet

- Common Examples of Liabilities in Real-Life Contexts

- Understanding the Impact of Liabilities on Financial Health

- Conclusion

What Are the Different Types of Liabilities?

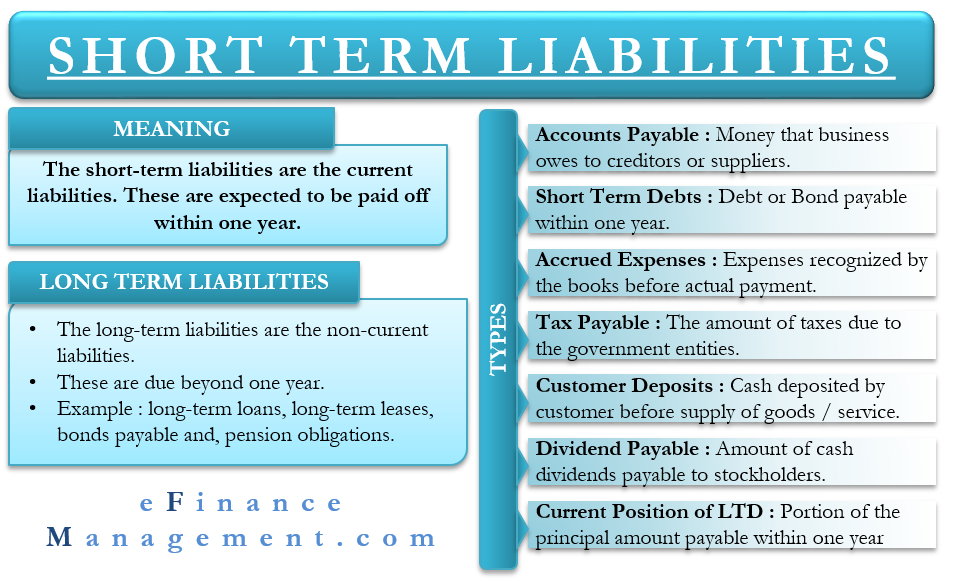

Alright, let’s start with the basics. In the financial world, liabilities are essentially the things you owe—whether it’s money, goods, or services. These obligations can take many forms, from formal commitments like bonds to everyday tasks like paying your utility bills. But here’s the key: they’re categorized based on when they’re due.

Think of it like this: liabilities are like the other side of the financial coin. When you subtract liabilities from assets, what you’re left with is owner’s equity. This equation—assets minus liabilities equals equity—is the foundation of every business’s financial snapshot. And when you look at a balance sheet, you’ll notice that liabilities are always on the right side, neatly organized and clearly separated from assets. It’s a system that makes financial accounting work like a well-oiled machine.

Current Liabilities: Short-Term Financial Responsibilities

Now, let’s talk about current liabilities. These are the financial obligations a company has to tackle within the next 12 months. They’re usually funded by current assets, like cash, accounts receivable, or inventory. These short-term responsibilities give us a good idea of a company’s liquidity and how well it can handle its day-to-day operations.

Here are some common types of current liabilities:

- Accounts payable: This is when businesses owe money for products or services they’ve already received but haven’t paid for yet. Think of it as the "IOU" section of your financial ledger.

- Wages payable: This represents the total income earned by employees but not yet paid. It’s a number that can fluctuate, especially in companies that pay their employees every two weeks.

- Interest payable: Often linked to short-term credit usage, this is the interest a company owes on loans or credit lines.

- Dividends payable: These are declared but unpaid distributions to shareholders. Once declared, they become part of the company’s current liabilities.

- Unearned revenues: This is when a company has received payment for a service or product but hasn’t delivered it yet. It’s like taking a deposit before you’ve done the work.

Let’s take dividends payable as an example. It’s technically an expense, but once it’s declared but unpaid, it becomes part of the company’s current liabilities. It’s a crucial part of a company’s short-term financial obligations.

Read also:Amy Grants Net Worth 2025 The Untold Story Of Her Success

And don’t forget deferred credits. These represent revenue that hasn’t been earned yet, so they’re treated as liabilities. For instance, if a customer pays for a service in advance, that money is recorded as a liability until the service is provided. It’s a fascinating aspect of how businesses handle unearned income.

Long-Term Liabilities: Obligations Beyond One Year

On the flip side, we have long-term liabilities. These are obligations that stretch beyond 12 months. They often involve big, strategic decisions—like taking on debt to expand operations or invest in infrastructure.

Here are a few examples:

- Bonds payable: When companies issue bonds, they’re essentially borrowing from investors in exchange for capital. It’s a long-term commitment that helps businesses grow.

- Mortgages: These are typically payable over extended periods, like 15 or 30 years. While the overall mortgage is considered a long-term liability, the portion due within the year is reported as a current liability.

- Deferred tax liabilities: These are postponed tax obligations that arise from differences in accounting methods. It’s like pushing a payment forward to a later date.

- Post-employment benefits: Think pensions and healthcare coverage for retirees. These are liabilities that accumulate over time as employees work for the company.

- Warranty liabilities: In sectors like manufacturing, these reflect the estimated future costs of repairing or replacing products. It’s a way for companies to prepare for potential issues down the line.

For example, in the automotive industry, companies estimate warranty liability based on the expected duration and cost of potential repairs. It’s a delicate balance—estimating conservatively enough to reflect real obligations without overinflating future expenses.

Special Liability Categories: Contingent, Legal, and Deferred

Not all liabilities are straightforward. Some, like contingent liabilities, only come into play depending on future events. Imagine a lawsuit, a product recall, or an environmental fine. A company might not have an active obligation today, but the potential for financial risk is still there.

Then there are legal liabilities. These arise from existing or potential litigation. Many companies carry liability insurance to protect themselves financially if a customer or employee decides to sue. It’s a smart move to shield themselves from unexpected costs.

And let’s not forget deferred credits. These are more technical but equally important. They often involve customer advances or prepayments and must be carefully timed for revenue recognition. For example, when a customer pays in advance for a service, that money is recorded as a liability until the service is delivered. At that point, the liability is reduced, and the amount is recorded as revenue.

These examples show how deferred revenue is collected before it’s earned and how liabilities can depend on future outcomes, such as a court ruling or the delivery of a service.

How Liabilities Appear on the Balance Sheet