Alright, here's the real deal: How much of your wealth can you actually tap into today if you need it? That’s where the critical distinction between net worth and liquid net worth comes into play. Let’s face it—having a big number on paper doesn’t mean much if you can’t access it when the chips are down.

While your overall net worth gives you a broad view of your financial picture, liquid net worth zeroes in on the cash you can grab quickly. It’s all about financial flexibility—and that’s what matters most in emergencies. Whether you’re handling your own finances or evaluating someone else’s, understanding this difference can make you smarter about planning for the future. Let’s dive deeper and break it down step by step.

Table of Contents

Read also:Roger Penskes Net Worth In 2025 The Man Behind The Motorsports Empire

- What Exactly Is Liquid Net Worth, and How Is It Different?

- How To Calculate Your Liquid Net Worth Precisely

- Understanding Liquid Assets vs Non-Liquid Assets

- Why Liquid Net Worth Is Crucial for Your Financial Plan

- How Liabilities Affect Your Liquid Net Worth

- Ways to Boost Your Liquid Net Worth

- Mistakes People Make When Assessing Liquid Net Worth

- Real-Life Scenarios That Highlight the Importance of Liquid Net Worth

- Final Thoughts

What Exactly Is Liquid Net Worth, and How Is It Different?

When we talk about net worth, we’re talking about everything you own—from your house and car to your retirement accounts and investments—minus everything you owe. But liquid net worth? That’s a whole different ball game. Liquid net worth is all about the assets that can be turned into cash quickly, like the money in your checking account, savings accounts, or even stocks and bonds you can sell in a pinch.

Think about it this way: You might have a high net worth because of a valuable home or a rare art collection, but if you can’t cover an unexpected car repair or medical bill tomorrow, your liquid net worth might be way lower than you think. That’s why understanding both is essential—one shows your overall wealth, while the other reveals what you can actually use right now.

Let’s break it down further:

- Liquid Assets: Cash, savings accounts, money market funds, stocks, bonds—these are the assets you can easily access.

- Non-Liquid Assets: Real estate, cars, retirement accounts with restrictions, collectibles—these take time and effort to sell, often at less than their full value.

- Liabilities: Mortgages, credit card balances, student loans, any debt you owe—these are the financial obligations that reduce your net worth.

Formula: Liquid Net Worth = Liquid Assets – Liabilities

This is how liquid net worth measures your financial flexibility, while total net worth gives you the big picture of your overall wealth.

Read also:Giannis Antetokounmpos Net Worth 2025 Salary Contracts And Nba Earnings

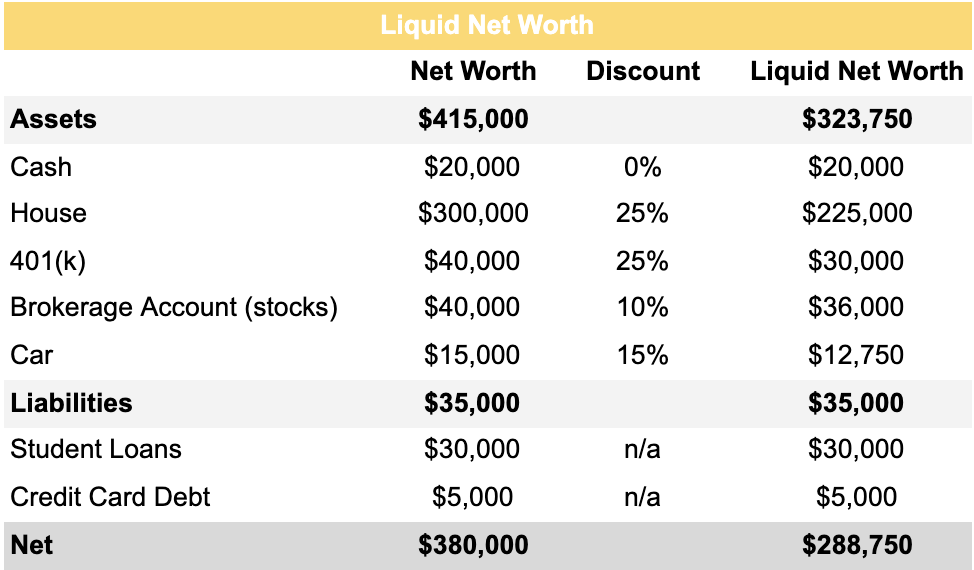

How To Calculate Your Liquid Net Worth Precisely

Calculating your liquid net worth doesn’t have to be complicated, but being accurate is key. Start by listing out all your liquid assets. This includes:

- Cash on hand

- Checking and savings accounts

- Stocks, ETFs, and mutual funds

- Short-term investments that can be quickly converted to cash

Once you’ve got your list, it’s time to subtract your liabilities. Don’t forget to include:

- Credit card debt

- Car loans

- Student loans

- Mortgage balance

If you want to include some non-liquid assets, like a piece of jewelry or a car, you can apply the 80% rule. This means you discount the estimated value by 20% to account for transaction fees or market fluctuations. It’s a smart way to get a more realistic number.

Understanding Liquid Assets vs Non-Liquid Assets

Liquid assets are your go-to financial resources during emergencies. They’re:

- Readily available

- Easily convertible to cash

- Stored in accounts you can access anytime

On the flip side, non-liquid assets take time and effort to sell—and sometimes you’ll lose money in the process. These include:

- Real estate and land

- Vehicles

- Collectibles like art or vintage items

- Retirement accounts with age restrictions or penalties

Knowing the difference between these two types of assets is key to building financial flexibility and preparing for whatever life throws your way.

Why Liquid Net Worth Is Crucial for Your Financial Plan

Liquid net worth plays a huge role in:

- Managing unexpected emergencies

- Ensuring you have quick access to cash when you need it

- Assessing your financial health in a realistic way

- Preparing for situations like job loss or unexpected medical expenses

For anyone serious about managing their money wisely, liquid net worth offers clarity on what you actually have access to right now—not just what’s on paper. It’s the difference between feeling financially secure