Let’s talk about the financial elite. Hitting the top 5 percent in net worth isn’t just about how much money you bring in—it’s about how you grow, protect, and manage what you’ve got. This guide breaks down how your income, assets, and financial decisions stack up and shows you how to climb into the upper echelons of wealth in America.

Table of Contents

- What It Takes to Be Among the Top 5 Percent Wealth Holders

- Comparing Your Financial Assets to the Elite 5 Percent

- Income Levels That Align with the Top 5 Percent Threshold

- Age-Based Wealth Progression Toward the Top 5 Percent

- Investing Habits That Drive the Wealthiest 5 Percent

- Saving More Than Spending: The Foundation of Wealth Building

- Why High Income Alone Doesn’t Guarantee Top 5 Percent Status

- How Age Influences Wealth Goals and Retirement Planning

- Tools and Strategies to Reach the Top 5 Percent

- Common Myths About High Net Worth Individuals

- Final Thoughts

What It Takes to Be Among the Top 5 Percent Wealth Holders

Read also:Hiro Mashimas Net Worth In 2025 A Closer Look At The Manga Legends Wealth

Being in the top 5 percent of wealth holders is a milestone that most people dream about but only a few achieve. According to the Federal Reserve’s Survey of Consumer Finances, this level starts at around $415,700 for young adults and climbs to over $6.6 million by your 60s. But reaching this level isn’t just about earning a big salary—it’s about building a foundation of financial wisdom that lasts a lifetime.

Take a moment to think about what it means to have more wealth than 95% of people your age. This doesn’t happen by accident. It’s the result of years of disciplined investing, smart financial decisions, and an ability to manage risk effectively. Whether you’re in your 20s or your 60s, your net worth grows as you accumulate assets, pay down debt, and make your money work for you.

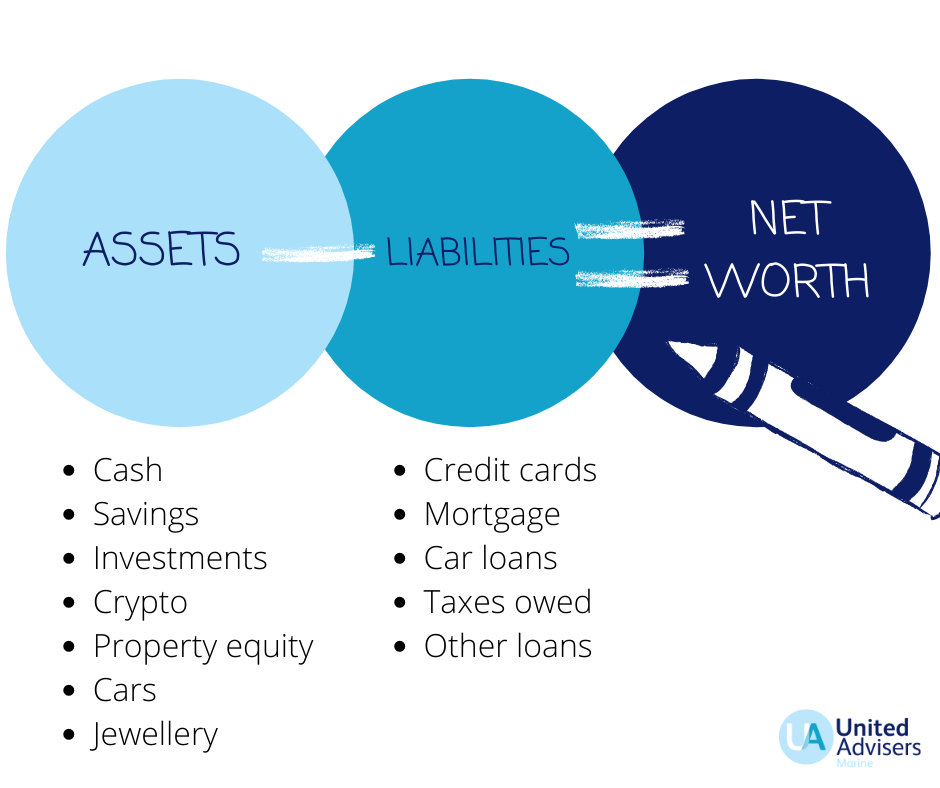

Comparing Your Financial Assets to the Elite 5 Percent

To truly understand where you stand, let’s dive into the types of assets that make up the wealth of the top 5 percent. It’s not just about having cash in the bank—it’s about owning a diverse portfolio of investments. Here’s what the elite typically have in their financial arsenals:

- Retirement accounts like 401(k)s and IRAs, which provide long-term tax advantages.

- Stocks and ETFs, especially diversified options like Vanguard’s VOO, which track the performance of the broader market.

- Real estate holdings, whether it’s rental properties or personal homes that appreciate over time.

- Business ownership or other income-generating assets that bring in passive revenue.

These assets aren’t just numbers on a spreadsheet—they’re the building blocks of lasting wealth. Even if you don’t feel rich day-to-day, consistent investing in assets like the S&P 500 can quietly build your net worth over the years. By the time you’re in your 50s, your net worth could reach $5,001,600 or more if you’ve been investing wisely.

Income Levels That Align with the Top 5 Percent Threshold

While income plays a role in building wealth, it’s not the only factor. To reach the top 5 percent by income, you’d need to earn around $598,825 annually in your 50s or $292,927 in your 30s. But here’s the catch: even if you’re earning a top-tier salary, only a fraction of people in your age group actually accumulate elite-level wealth.

Why is that? Because wealth isn’t just about what you earn—it’s about how you convert that income into assets. Sure, earning a high salary gives you more resources to work with, but it’s your discipline and strategy that truly determine your financial future. Think of it this way: earning big paychecks without a plan is like filling a bucket with holes—it won’t hold water for long.

Read also:David Zuckermans Net Worth 2025 A Deep Dive Into His Wealth And Success

Age-Based Wealth Progression Toward the Top 5 Percent

Your financial journey changes as you age, and so do the benchmarks for success. In your 20s, crossing the $415,700 mark puts you in rare company. By your 60s, that benchmark climbs to nearly $6.7 million. Let’s break it down by age group:

| Age Group | 95th Percentile Net Worth |

|---|---|

| 18–29 | $415,700 |

| 30–39 | $1,104,100 |

| 40–49 | $2,551,500 |

| 50–59 | $5,001,600 |

| 60–69 | $6,684,220 |

| 70+ | $5,860,400 |

As you move through life, your income becomes a smaller piece of the puzzle. In your 40s and 50s, the compounding effect of years of smart investing starts to pay off. This is when you truly see the power of patience and discipline in action.

Investing Habits That Drive the Wealthiest 5 Percent

When it comes to investing, the top 5 percent don’t just throw money at the market—they follow proven strategies. Here’s what they’re doing:

- Investing in low-cost index funds like the Vanguard S&P 500 ETF (VOO), which provide broad market exposure.

- Building diversified portfolios that include a mix of bonds, real estate, and growth stocks to balance risk and reward.

- Focusing on sectors they understand, where they can weigh risks and opportunities carefully.

These habits show that the wealthiest individuals aren’t just chasing quick wins—they’re playing the long game.