Facebook Ads have become an indispensable tool for insurance businesses aiming to expand their reach and connect with potential clients. In today's digital age, leveraging social media platforms like Facebook is crucial to grow your insurance business. With billions of active users, Facebook provides a vast audience for insurance companies to target and engage with.

Insurance Facebook Ads offer an unparalleled opportunity to showcase your services to a well-defined demographic, ensuring that your message reaches the right people at the right time. By strategically planning and executing your ad campaigns, you can significantly enhance your business's visibility and credibility in the competitive insurance market.

This article will delve deep into the world of insurance Facebook Ads, exploring various strategies, tips, and best practices to make your campaigns more effective. Whether you're a seasoned marketer or just starting out, this guide will equip you with the knowledge and tools needed to succeed in the realm of Facebook advertising for insurance.

Read also:Michael Strahans Net Worth In 2025 A Closer Look At His Wealth And Success

Table of Contents

- Introduction to Insurance Facebook Ads

- Benefits of Using Facebook Ads for Insurance

- Targeting the Right Audience

- Effective Strategies for Insurance Facebook Ads

- Budgeting for Facebook Ad Campaigns

- Types of Facebook Ads for Insurance

- Optimizing Your Insurance Facebook Ads

- Key Metrics to Track for Success

- Common Challenges in Facebook Advertising

- The Future of Insurance Facebook Ads

- Conclusion and Call to Action

Introduction to Insurance Facebook Ads

Facebook Ads are a powerful tool that insurance companies can utilize to promote their services and reach potential clients. These ads allow businesses to target specific demographics, interests, and behaviors, ensuring that their message is seen by the most relevant audience. As Facebook continues to grow in popularity, the platform provides an excellent opportunity for insurance companies to enhance their digital presence.

Insurance Facebook Ads can be tailored to fit the needs of various insurance types, from auto and home insurance to life and health insurance. By understanding the platform's capabilities and utilizing its features effectively, businesses can create campaigns that resonate with their target audience and drive meaningful results.

Benefits of Using Facebook Ads for Insurance

There are numerous advantages to incorporating Facebook Ads into your insurance marketing strategy. Some of the key benefits include:

- Targeted Advertising: Facebook Ads allow businesses to target specific demographics, ensuring that their message reaches the right audience.

- Cost-Effective: With Facebook Ads, you can set a budget that fits your business needs, making it an affordable marketing option.

- Measurable Results: Facebook provides detailed analytics, allowing businesses to track the performance of their campaigns and make data-driven decisions.

By leveraging these benefits, insurance companies can create campaigns that drive engagement and conversions, ultimately leading to increased sales and customer satisfaction.

Targeting the Right Audience

Understanding Your Target Market

To create successful insurance Facebook Ads, it's essential to understand your target audience. This involves identifying the demographics, interests, and behaviors of potential clients. By gathering this information, you can create campaigns that resonate with your audience and address their specific needs.

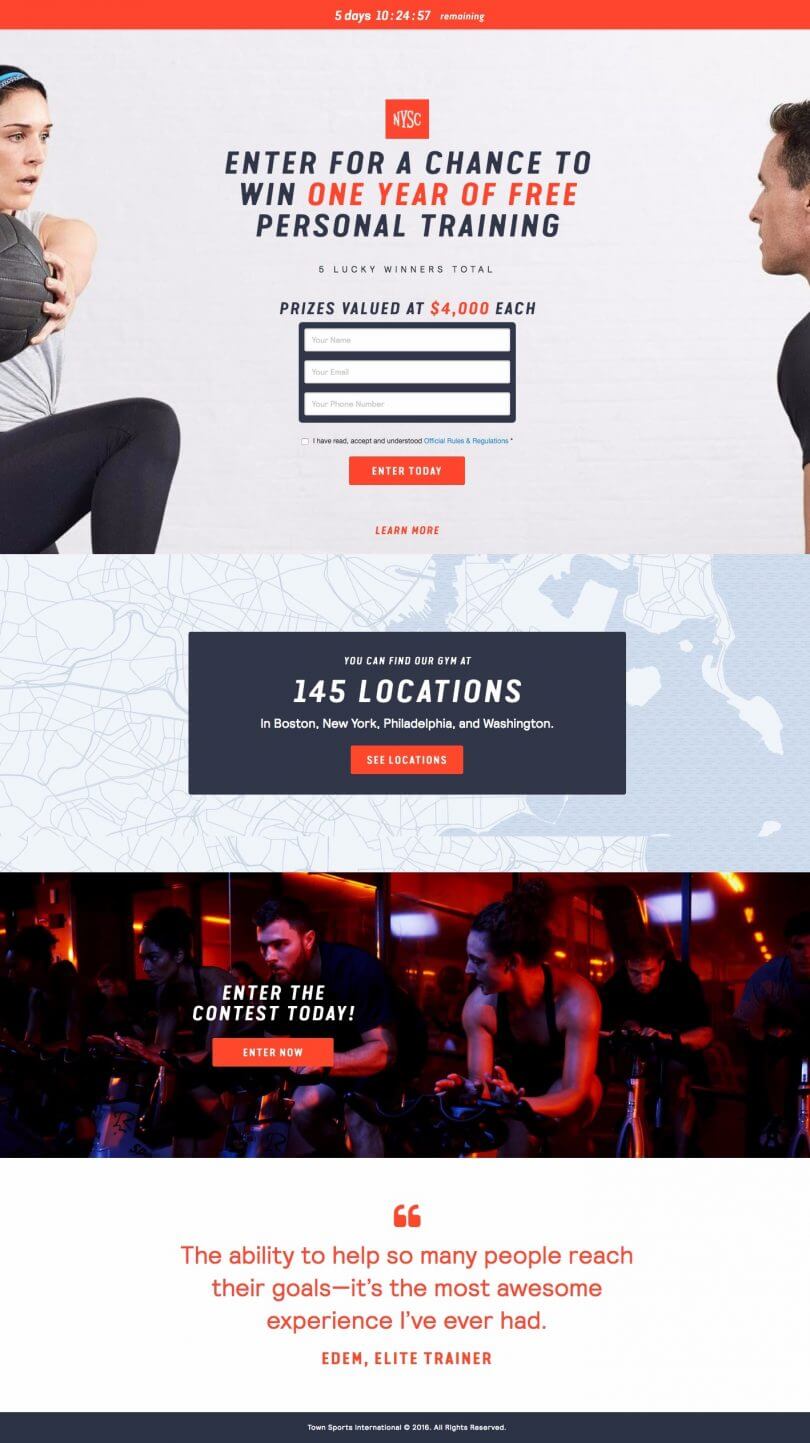

Creating Custom Audiences

Facebook's custom audience feature allows businesses to target users who have already interacted with their brand. This can include individuals who have visited your website, engaged with your content, or made a purchase. By focusing on these users, you can increase the likelihood of conversions and improve your campaign's ROI.

Read also:Behgjet Pacollis Journey To Wealth A Closer Look At His Net Worth And Business Empire In 2025

Effective Strategies for Insurance Facebook Ads

Implementing the right strategies is crucial to the success of your insurance Facebook Ads. Here are some tips to help you create effective campaigns:

- Set Clear Goals: Define what you want to achieve with your campaign, whether it's increasing brand awareness, generating leads, or driving sales.

- Optimize Ad Copy: Craft compelling ad copy that highlights the benefits of your insurance services and encourages users to take action.

- Use High-Quality Visuals: Incorporate eye-catching images and videos to capture the attention of your audience and make your ads stand out.

By following these strategies, you can create campaigns that effectively engage your target audience and drive results.

Budgeting for Facebook Ad Campaigns

Setting a budget for your insurance Facebook Ads is an important step in ensuring the success of your campaign. It's essential to consider factors such as your business goals, target audience size, and ad format when determining your budget. Facebook offers flexible bidding options, allowing businesses to control their spending and maximize their ROI.

Additionally, it's important to regularly monitor your campaign's performance and adjust your budget as needed. This will help you allocate your resources efficiently and ensure that your campaigns remain cost-effective.

Types of Facebook Ads for Insurance

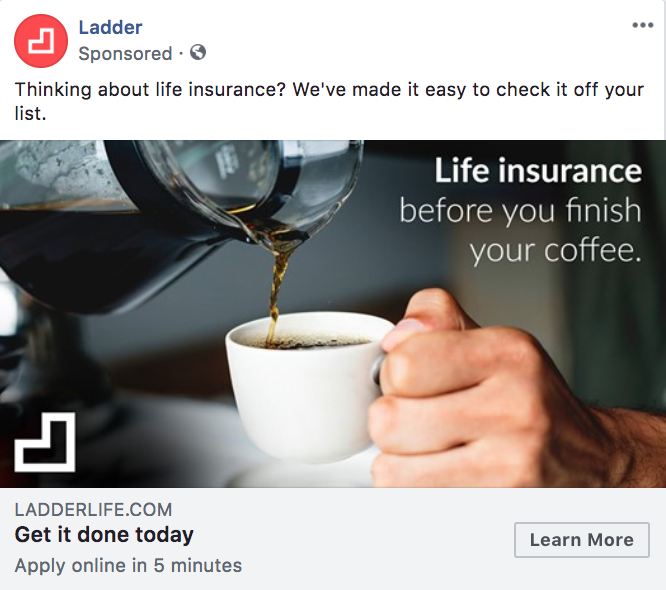

Image Ads

Image ads are a simple yet effective way to promote your insurance services on Facebook. These ads consist of a single image accompanied by ad copy and a call-to-action button. When creating image ads, it's important to use high-quality visuals that capture the attention of your audience and convey your message effectively.

Video Ads

Video ads are an increasingly popular format for Facebook advertising, offering businesses the opportunity to showcase their services through engaging content. Insurance companies can use video ads to explain their offerings, highlight customer testimonials, or provide educational content related to insurance.

Optimizing Your Insurance Facebook Ads

To ensure the success of your insurance Facebook Ads, it's important to continuously optimize your campaigns. This involves testing different ad formats, targeting options, and ad copy to determine what works best for your business. A/B testing is a valuable tool for identifying the most effective elements of your campaigns and making data-driven improvements.

Additionally, regularly analyzing your campaign's performance and adjusting your strategy as needed will help you achieve better results and maximize your ROI.

Key Metrics to Track for Success

Tracking the right metrics is crucial to understanding the performance of your insurance Facebook Ads. Some key metrics to monitor include:

- Click-Through Rate (CTR): Measures the percentage of users who click on your ad after seeing it.

- Conversion Rate: Indicates the percentage of users who complete a desired action after clicking on your ad.

- Cost Per Acquisition (CPA): Represents the cost of acquiring a new customer through your ad campaign.

By tracking these metrics, you can gain valuable insights into the effectiveness of your campaigns and make informed decisions to improve their performance.

Common Challenges in Facebook Advertising

While Facebook Ads offer numerous benefits for insurance businesses, there are also challenges that companies may face when implementing their campaigns. Some common challenges include:

- Ad Fatigue: Occurs when users become tired of seeing the same ads repeatedly, leading to decreased engagement.

- Algorithm Changes: Facebook frequently updates its algorithm, which can impact the visibility and performance of your ads.

- Competition: The insurance industry is highly competitive, making it challenging to stand out in a crowded market.

By being aware of these challenges and taking steps to address them, businesses can overcome obstacles and create successful Facebook ad campaigns.

The Future of Insurance Facebook Ads

As technology continues to evolve, so too will the landscape of insurance Facebook Ads. Advances in artificial intelligence, machine learning, and data analytics will enable businesses to create even more targeted and personalized campaigns. Additionally, new ad formats and features may emerge, providing insurance companies with even more opportunities to connect with potential clients.

Staying informed about industry trends and advancements will be crucial for insurance businesses looking to maintain a competitive edge in the world of Facebook advertising.

Conclusion and Call to Action

In conclusion, insurance Facebook Ads offer a powerful way for businesses to promote their services and connect with potential clients. By understanding the platform's capabilities, implementing effective strategies, and continuously optimizing your campaigns, you can achieve meaningful results and grow your business.

We encourage you to take action by creating your own insurance Facebook Ads and exploring the various opportunities they provide. Don't forget to share your thoughts and experiences in the comments below, and check out our other articles for more valuable insights into the world of digital marketing.